Page 96 - Amata-one-report2020-en

P. 96

96

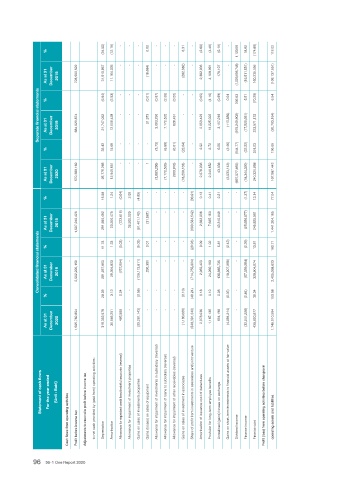

% (34.50) (12.18) - - - 0.02 - - - 0.31 - (2.60) (4.48) (0.19) - 1,123.69 18.02 (174.88) 118.02

As at 31 December 2018 728,590,522 31,610,867 11,164,035 - - - - - - (18,684) - - - (282,082) - - - 2,382,936 4,108,991 178,107 - (1,029,595,748) (16,511,551) 160,235,056 (108,137,551)

Separate financial statements % As at 31 December 2019 684,923,874 (6.84) 21,747,052 (3.93) 12,506,428 - - - (0.01) 21,973 (0.97) 3,083,250 (2.26) 7,172,520 (0.20) 628,431 - - (0.65) 2,053,423 (4.16) 13,225,022 (0.99) 3,157,249 0.04 (113,586) 306.63 (975,249,902) 5.51 (17,520,031) (70.29) 223,571,133 6.54 (20,793,164)

% 32.43 15.68 - - - - (3.73) (8.69) (0.61) (22.04) - 2.52 2.72 0.05 (2.46) (844.77) (22.22) 291.03 130.65

As at 31 December 2020 570,388,169 26,776,268 12,945,851 - - - 1 (3,083,250) (7,172,520) (503,910) (18,200,163) - 2,078,036 2,249,852 43,038 (2,033,142) (697,577,455) (18,344,320) 240,320,988 107,887,443

% 15.58 1.24 (0.04) 2.06 (4.89) - - - - - (36.91) 0.13 0.41 2.31 - - (1.37) 13.14 77.04

As at 31 December 2018 1,597,240,426 291,580,492 23,206,475 (723,618) 38,500,000 - (91,401,149) (31,967) - - - - - - - - (690,564,542) 2,382,936 7,635,160 43,310,648 - - - (25,656,677) 245,825,981 1,441,304,165

Consolidated financial statements % As at 31 December 2019 2,502,220,150 11.78 281,237,063 1.23 29,394,833 (0.03) (767,894) - (5.03) (120,113,811) 0.01 290,351 - - - - (29.93) (714,755,904) 0.09 2,053,423 1.02 24,260,183 5.81 138,682,735 (0.42) (10,007,886) - (2.39) (57,039,284) 13.81 329,904,674 100.71 2,405,358,633

% 28.09 3.13 0.04 - (2.58) - - - - (0.10) (48.24) 0.18 0.10 0.08 (0.36) - (2.84) 38.34 153.58

As at 31 December 2020 1,565,782,854 319,353,578 35,545,251 466,589 - (29,281,143) - - - - (1,180,000) (548,391,340) 2,078,036 1,187,136 854,198 (4,084,214) - (32,241,228) 435,920,877 1,746,010,594

Statement of cash flows For the year ended (Unit : Baht) to net cash provided by (paid from) operating activities: Allowance for expected credit loss/doubtful accounts (reversal) Allowance for impairment of investment properties Allowance for impairment of investments in subsidiary (reversal) Allowance for impairment of loans to subsidiary (reversal) Allowance for impairment of other receivables (reversal) Share of profit from investments in associate

Cash flows from operating activities Profit before income tax Adjustments to reconcile profit before income tax Depreciation Amortisation Gains on sales of investments properties Gains (losses) on sales of equipment Gains on sales of investment in associates Amortisation of issuance cost of debentures Provision for long-term employee benefits Unrealised (gains) losses on exchange Dividend income Finance income Finance cost operatin

96 56-1 One Report 2020