Page 209 - Amata-one-report2020-en

P. 209

BUSINESS OPERATION AND OPERATING RESULTS CORPORATE GOVERNANCE FINANCIAL STATEMENTS ENCLOSURES

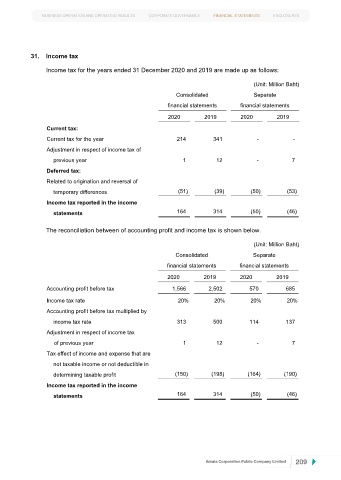

31. Income tax

Income tax for the years ended 31 December 2020 and 2019 are made up as follows:

(Unit: Million Baht)

Consolidated Separate

financial statements financial statements

2020 2019 2020 2019

Current tax:

Current tax for the year 214 341 - -

Adjustment in respect of income tax of

previous year 1 12 - 7

Deferred tax:

Related to origination and reversal of

temporary differences (51) (39) (50) (53)

Income tax reported in the income

statements 164 314 (50) (46)

The reconciliation between of accounting profit and income tax is shown below.

(Unit: Million Baht)

Consolidated Separate

financial statements financial statements

2020 2019 2020 2019

Accounting profit before tax 1,566 2,502 570 685

Income tax rate 20% 20% 20% 20%

Accounting profit before tax multiplied by

income tax rate 313 500 114 137

Adjustment in respect of income tax

of previous year 1 12 - 7

Tax effect of income and expense that are

not taxable income or not deductible in

determining taxable profit (150) (198) (164) (190)

Income tax reported in the income

statements 164 314 (50) (46)

Amata Corporation Public Company Limited 56 209