Page 210 - Amata-one-report2020-en

P. 210

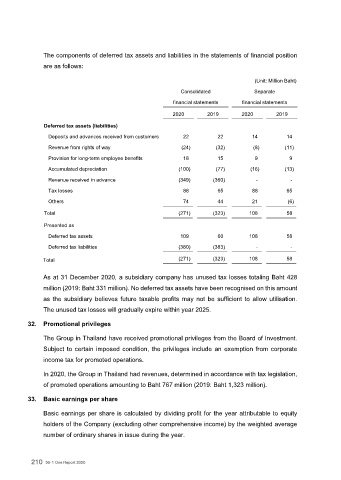

The components of deferred tax assets and liabilities in the statements of financial position

are as follows:

(Unit: Million Baht)

Consolidated Separate

financial statements financial statements

2020 2019 2020 2019

Deferred tax assets (liabilities)

Deposits and advances received from customers 22 22 14 14

Revenue from rights of way (24) (32) (8) (11)

Provision for long-term employee benefits 18 15 9 9

Accumulated depreciation (100) (77) (16) (13)

Revenue received in advance (349) (360) - -

Tax losses 88 65 88 65

Others 74 44 21 (6)

Total (271) (323) 108 58

Presented as

Deferred tax assets 109 60 108 58

Deferred tax liabilities (380) (383) - -

Total (271) (323) 108 58

As at 31 December 2020, a subsidiary company has unused tax losses totaling Baht 428

million (2019: Baht 331 million). No deferred tax assets have been recognised on this amount

as the subsidiary believes future taxable profits may not be sufficient to allow utilisation.

The unused tax losses will gradually expire within year 2025.

32. Promotional privileges

The Group in Thailand have received promotional privileges from the Board of Investment.

Subject to certain imposed condition, the privileges include an exemption from corporate

income tax for promoted operations.

In 2020, the Group in Thailand had revenues, determined in accordance with tax legislation,

of promoted operations amounting to Baht 767 million (2019: Baht 1,323 million).

33. Basic earnings per share

Basic earnings per share is calculated by dividing profit for the year attributable to equity

holders of the Company (excluding other comprehensive income) by the weighted average

number of ordinary shares in issue during the year.

210 56-1 One Report 2020

57