Page 238 - Amata-one-report2020-en

P. 238

Enclosures 4

Assets Used in Business Operations

and Asset Valuation

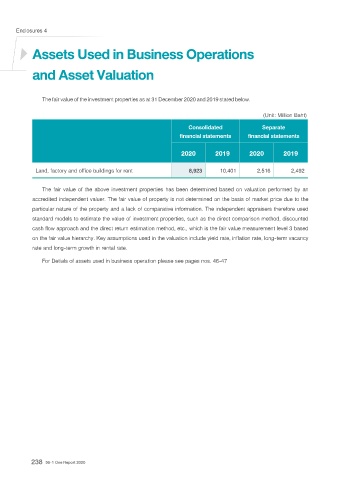

The fair value of the investment properties as at 31 December 2020 and 2019 stated below.

(Unit: Million Baht)

Consolidated Separate

financial statements financial statements

2020 2019 2020 2019

Land, factory and office buildings for rent 8,923 10,401 2,516 2,492

The fair value of the above investment properties has been determined based on valuation performed by an

accredited independent valuer. The fair value of property is not determined on the basis of market price due to the

particular nature of the property and a lack of comparative information. The independent appraisers therefore used

standard models to estimate the value of investment properties, such as the direct comparison method, discounted

cash flow approach and the direct return estimation method, etc., which is the fair value measurement level 3 based

on the fair value hierarchy. Key assumptions used in the valuation include yield rate, inflation rate, long-term vacancy

rate and long-term growth in rental rate.

For Detials of assets used in business operation please see pages nos. 46-47

238 56-1 One Report 2020