Page 13 - Consumer Mathematics

P. 13

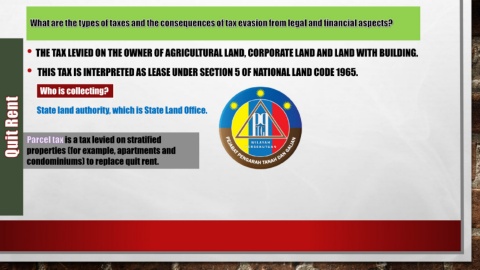

• THE TAX LEVIED ON THE OWNER OF AGRICULTURAL LAND, CORPORATE LAND AND LAND WITH BUILDING.

• THIS TAX IS INTERPRETED AS LEASE UNDER SECTION 5 OF NATIONAL LAND CODE 1965.

Who is collecting?

State land authority, which is State Land Office.

is a tax levied on stratified

properties (for example, apartments and

condominiums) to replace quit rent.