Page 15 - Consumer Mathematics

P. 15

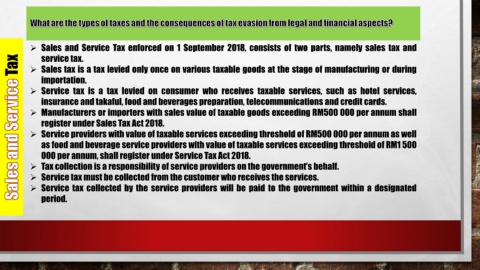

➢ Sales and Service Tax enforced on 1 September 2018, consists of two parts, namely sales tax and

service tax.

Tax ➢ Sales tax is a tax levied only once on various taxable goods at the stage of manufacturing or during

importation.

➢ Service tax is a tax levied on consumer who receives taxable services, such as hotel services,

insurance and takaful, food and beverages preparation, telecommunications and credit cards.

➢ Manufacturers or importers with sales value of taxable goods exceeding RM500 000 per annum shall

register under Sales Tax Act 2018.

➢ Service providers with value of taxable services exceeding threshold of RM500 000 per annum as well

as food and beverage service providers with value of taxable services exceeding threshold of RM1 500

000 per annum, shall register under Service Tax Act 2018.

➢ Tax collection is a responsibility of service providers on the government’s behalf.

➢ Service tax must be collected from the customer who receives the services.

➢ Service tax collected by the service providers will be paid to the government within a designated

period.