Page 20 - Consumer Mathematics

P. 20

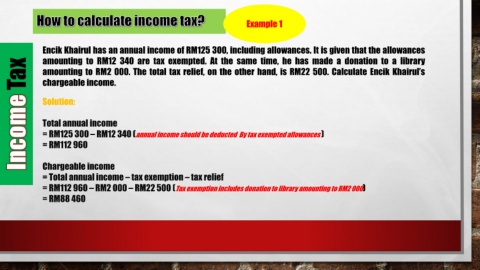

Example 1

Encik Khairul has an annual income of RM125 300, including allowances. It is given that the allowances

amounting to RM12 340 are tax exempted. At the same time, he has made a donation to a library

Tax amounting to RM2 000. The total tax relief, on the other hand, is RM22 500. Calculate Encik Khairul’s

chargeable income.

Solution:

Total annual income

= RM125 300 – RM12 340 (annual income should be deducted By tax exempted allowances )

= RM112 960

Chargeable income

= Total annual income – tax exemption – tax relief

= RM112 960 – RM2 000 – RM22 500 (Tax exemption includes donation to library amounting to RM2 000)

= RM88 460