Page 22 - Consumer Mathematics

P. 22

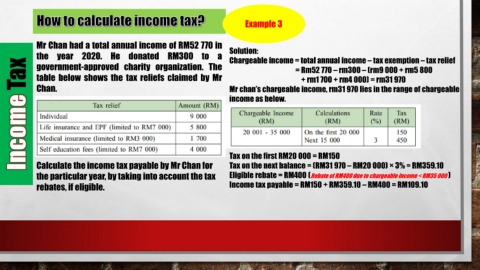

Example 3

Mr Chan had a total annual income of RM52 770 in Solution:

the year 2020. He donated RM300 to a Chargeable income = total annual income – tax exemption – tax relief

Tax government-approved charity organization. The = Rm52 770 – rm300 – (rm9 000 + rm5 800

table below shows the tax reliefs claimed by Mr

+ rm1 700 + rm4 000) = rm31 970

Chan.

Mr chan’s chargeable income, rm31 970 lies in the range of chargeable

income as below.

Tax on the first RM20 000 = RM150

Calculate the income tax payable by Mr Chan for Tax on the next balance = (RM31 970 – RM20 000) × 3% = RM359.10

the particular year, by taking into account the tax Eligible rebate = RM400 (Rebate of RM400 due to chargeable income < RM35 000 )

rebates, if eligible. Income tax payable = RM150 + RM359.10 – RM400 = RM109.10