Page 25 - Consumer Mathematics

P. 25

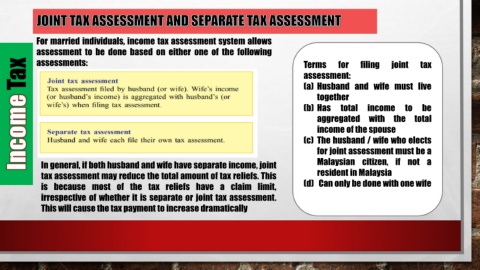

For married individuals, income tax assessment system allows

assessment to be done based on either one of the following

assessments:

Tax Terms for filing joint tax

assessment:

(a) Husband and wife must live

together

(b) Has total income to be

aggregated with the total

income of the spouse

(c) The husband / wife who elects

for joint assessment must be a

In general, if both husband and wife have separate income, joint Malaysian citizen, if not a

tax assessment may reduce the total amount of tax reliefs. This resident in Malaysia

is because most of the tax reliefs have a claim limit, (d) Can only be done with one wife

irrespective of whether it is separate or joint tax assessment.

This will cause the tax payment to increase dramatically