Page 26 - Consumer Mathematics

P. 26

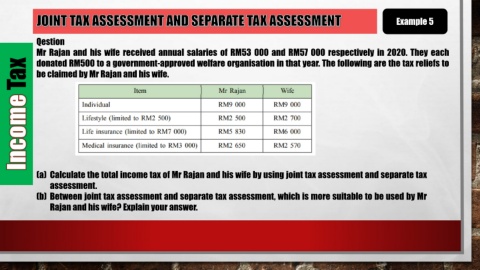

Example 5

Qestion

Mr Rajan and his wife received annual salaries of RM53 000 and RM57 000 respectively in 2020. They each

Tax be claimed by Mr Rajan and his wife.

donated RM500 to a government-approved welfare organisation in that year. The following are the tax reliefs to

(a) Calculate the total income tax of Mr Rajan and his wife by using joint tax assessment and separate tax

assessment.

(b) Between joint tax assessment and separate tax assessment, which is more suitable to be used by Mr

Rajan and his wife? Explain your answer.