Page 27 - Consumer Mathematics

P. 27

Example 5

Solution:

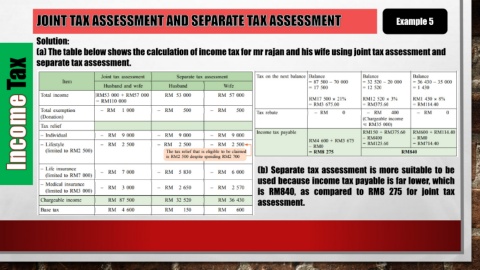

(a) The table below shows the calculation of income tax for mr rajan and his wife using joint tax assessment and

separate tax assessment.

Tax

(b) Separate tax assessment is more suitable to be

used because income tax payable is far lower, which

is RM840, as compared to RM8 275 for joint tax

assessment.