Page 24 - Consumer Mathematics

P. 24

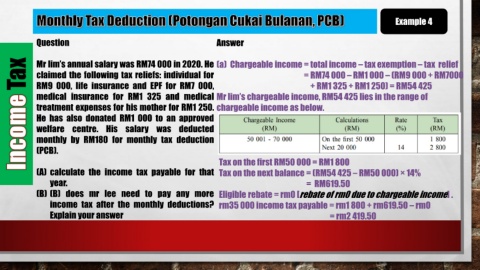

Example 4

Question Answer

Tax Mr lim’s annual salary was RM74 000 in 2020. He (a) Chargeable income = total income – tax exemption – tax relief

claimed the following tax reliefs: individual for

= RM74 000 – RM1 000 – (RM9 000 + RM7000

+ RM1 325 + RM1 250) = RM54 425

RM9 000, life insurance and EPF for RM7 000,

medical insurance for RM1 325 and medical Mr lim’s chargeable income, RM54 425 lies in the range of

treatment expenses for his mother for RM1 250. chargeable income as below.

He has also donated RM1 000 to an approved

welfare centre. His salary was deducted

monthly by RM180 for monthly tax deduction

(PCB).

Tax on the first RM50 000 = RM1 800

(A) calculate the income tax payable for that Tax on the next balance = (RM54 425 – RM50 000) × 14%

year. = RM619.50

(B) (B) does mr lee need to pay any more Eligible rebate = rm0 [rebate of rm0 due to chargeable income] .

income tax after the monthly deductions? rm35 000 income tax payable = rm1 800 + rm619.50 – rm0

Explain your answer = rm2 419.50