Page 21 - Consumer Mathematics

P. 21

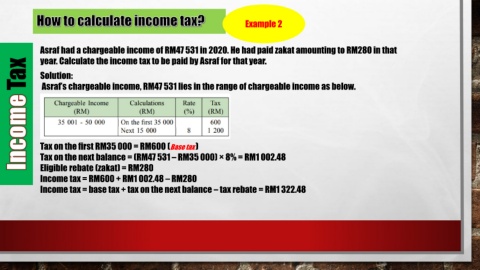

Example 2

Asraf had a chargeable income of RM47 531 in 2020. He had paid zakat amounting to RM280 in that

year. Calculate the income tax to be paid by Asraf for that year.

Tax Solution:

Asraf’s chargeable income, RM47 531 lies in the range of chargeable income as below.

Tax on the first RM35 000 = RM600 (Base tax )

Tax on the next balance = (RM47 531 – RM35 000) × 8% = RM1 002.48

Eligible rebate (zakat) = RM280

Income tax = RM600 + RM1 002.48 – RM280

Income tax = base tax + tax on the next balance – tax rebate = RM1 322.48