Page 110 - KRCL ENglish

P. 110

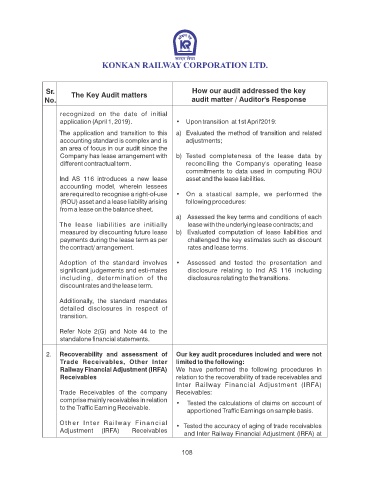

Sr. The Key Audit matters How our audit addressed the key

No. audit matter / Auditor's Response

recognized on the date of initial

application (April 1, 2019). • Upon transition at 1st April'2019:

The application and transition to this a) Evaluated the method of transition and related

accounting standard is complex and is adjustments;

an area of focus in our audit since the

Company has lease arrangement with b) Tested completeness of the lease data by

different contractual term. reconciling the Company's operating lease

commitments to data used in computing ROU

Ind AS 116 introduces a new lease asset and the lease liabilities.

accounting model, wherein lessees

are required to recognise a right-of-use • On a stastical sample, we performed the

(ROU) asset and a lease liability arising following procedures:

from a lease on the balance sheet.

a) Assessed the key terms and conditions of each

The lease liabilities are initially lease with the underlying lease contracts; and

measured by discounting future lease b) Evaluated computation of lease liabilities and

payments during the lease term as per challenged the key estimates such as discount

the contract/ arrangement. rates and lease terms.

Adoption of the standard involves • Assessed and tested the presentation and

signicant judgements and esti-mates disclosure relating to Ind AS 116 including

including, determination of the disclosures relating to the transitions.

discount rates and the lease term.

Additionally, the standard mandates

detailed disclosures in respect of

transition.

Refer Note 2(G) and Note 44 to the

standalone nancial statements.

2. Recoverability and assessment of Our key audit procedures included and were not

Trade Receivables, Other Inter limited to the following:

Railway Financial Adjustment (IRFA) We have performed the following procedures in

Receivables relation to the recoverability of trade receivables and

Inter Railway Financial Adjustment (IRFA)

Trade Receivables of the company Receivables:

comprise mainly receivables in relation • Tested the calculations of claims on account of

to the Trafc Earning Receivable.

apportioned Trafc Earnings on sample basis.

Other Inter Railway Financial • Tested the accuracy of aging of trade receivables

Adjustment (IRFA) Receivables

and Inter Railway Financial Adjustment (IRFA) at

108