Page 111 - KRCL ENglish

P. 111

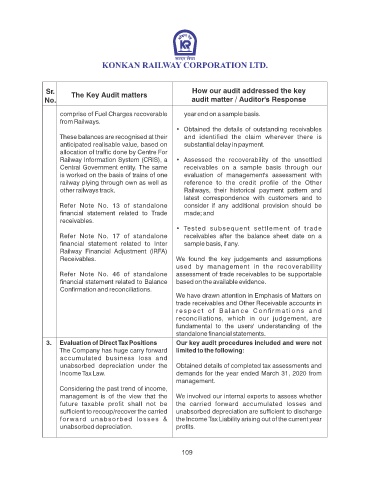

Sr. The Key Audit matters How our audit addressed the key

No. audit matter / Auditor's Response

comprise of Fuel Charges recoverable year end on a sample basis.

from Railways.

• Obtained the details of outstanding receivables

These balances are recognised at their and identied the claim wherever there is

anticipated realisable value, based on substantial delay in payment.

allocation of trafc done by Centre For

Railway Information System (CRIS), a • Assessed the recoverability of the unsettled

Central Government entity. The same receivables on a sample basis through our

is worked on the basis of trains of one evaluation of management's assessment with

railway plying through own as well as reference to the credit prole of the Other

other railways track. Railways, their historical payment pattern and

latest correspondence with customers and to

Refer Note No. 13 of standalone consider if any additional provision should be

nancial statement related to Trade made; and

receivables.

• Tested subsequent settlement of trade

Refer Note No. 17 of standalone receivables after the balance sheet date on a

nancial statement related to Inter sample basis, if any.

Railway Financial Adjustment (IRFA)

Receivables. We found the key judgements and assumptions

used by management in the recoverability

Refer Note No. 46 of standalone assessment of trade receivables to be supportable

nancial statement related to Balance based on the available evidence.

Conrmation and reconciliations.

We have drawn attention in Emphasis of Matters on

trade receivables and Other Receivable accounts in

r e s p e c t o f B a l a n c e C o n r m a t i o n s a n d

reconciliations, which in our judgement, are

fundamental to the users' understanding of the

standalone nancial statements.

3. Evaluation of Direct Tax Positions Our key audit procedures included and were not

The Company has huge carry forward limited to the following:

accumulated business loss and

unabsorbed depreciation under the Obtained details of completed tax assessments and

Income Tax Law. demands for the year ended March 31, 2020 from

management.

Considering the past trend of income,

management is of the view that the We involved our internal experts to assess whether

future taxable prot shall not be the carried forward accumulated losses and

sufcient to recoup/recover the carried unabsorbed depreciation are sufcient to discharge

forward unabsorbed losses & the Income Tax Liability arising out of the current year

unabsorbed depreciation. prots.

109