Page 123 - KRCL ENglish

P. 123

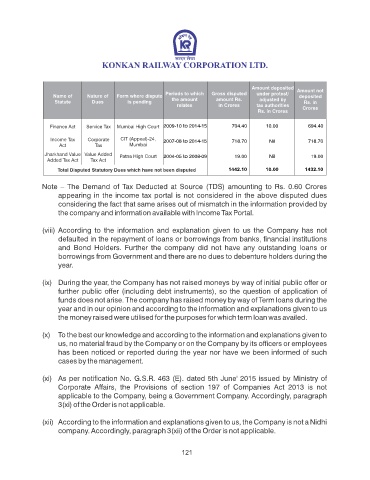

Amount deposited Amount not

Periods to which Gross disputed under protest/

Name of Nature of Form where dispute deposited

Statute Dues is pending the amount amount Rs. adjusted by Rs. in

relates in Crores tax authorities Crores

Rs. in Crores

Finance Act Service Tax Mumbai High Court 2009-10 to 2014-15 704.40 10.00 694.40

Income Tax Corporate CIT (Appeal)-24, 2007-08 to 2014-15 718.70 Nil 718.70

Act Tax Mumbai

Jharkhand Value Value Added Patna High Court 2004-05 to 2008-09 19.00 Nil 19.00

Added Tax Act Tax Act

Total Disputed Statutory Dues which have not been disputed 1442.10 10.00 1432.10

Note – The Demand of Tax Deducted at Source (TDS) amounting to Rs. 0.60 Crores

appearing in the income tax portal is not considered in the above disputed dues

considering the fact that same arises out of mismatch in the information provided by

the company and information available with Income Tax Portal.

(viii) According to the information and explanation given to us the Company has not

defaulted in the repayment of loans or borrowings from banks, nancial institutions

and Bond Holders. Further the company did not have any outstanding loans or

borrowings from Government and there are no dues to debenture holders during the

year.

(ix) During the year, the Company has not raised moneys by way of initial public offer or

further public offer (including debt instruments), so the question of application of

funds does not arise. The company has raised money by way of Term loans during the

year and in our opinion and according to the information and explanations given to us

the money raised were utilised for the purposes for which term loan was availed.

(x) To the best our knowledge and according to the information and explanations given to

us, no material fraud by the Company or on the Company by its ofcers or employees

has been noticed or reported during the year nor have we been informed of such

cases by the management.

(xi) As per notication No. G.S.R. 463 (E). dated 5th June' 2015 issued by Ministry of

Corporate Affairs, the Provisions of section 197 of Companies Act 2013 is not

applicable to the Company, being a Government Company. Accordingly, paragraph

3(xi) of the Order is not applicable.

(xii) According to the information and explanations given to us, the Company is not a Nidhi

company. Accordingly, paragraph 3(xii) of the Order is not applicable.

121