Page 127 - KRCL ENglish

P. 127

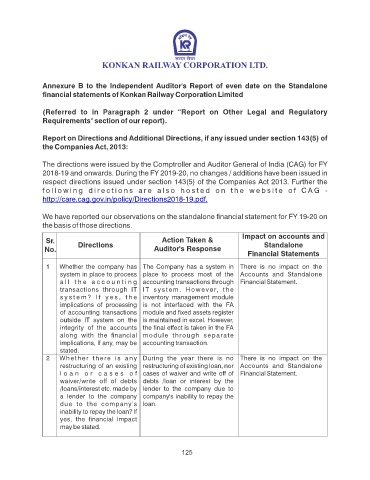

Annexure B to the Independent Auditor's Report of even date on the Standalone

nancial statements of Konkan Railway Corporation Limited

(Referred to in Paragraph 2 under “Report on Other Legal and Regulatory

Requirements'' section of our report).

Report on Directions and Additional Directions, if any issued under section 143(5) of

the Companies Act, 2013:

The directions were issued by the Comptroller and Auditor General of India (CAG) for FY

2018-19 and onwards. During the FY 2019-20, no changes / additions have been issued in

respect directions issued under section 143(5) of the Companies Act 2013. Further the

f o l l o w i n g d i r e c t i o n s a r e a l s o h o s t e d o n t h e w e b s i t e o f C A G -

http://care.cag.gov.in/policy/Directions2018-19.pdf.

We have reported our observations on the standalone nancial statement for FY 19-20 on

the basis of those directions.

Impact on accounts and

Sr. Action Taken &

Directions Standalone

No. Auditor's Response

Financial Statements

1 Whether the company has The Company has a system in There is no impact on the

system in place to process place to process most of the Accounts and Standalone

a l l t h e a c c o u n t i n g accounting transactions through Financial Statement.

transactions through IT IT system. However, the

s y s t e m ? I f y e s , t h e inventory management module

implications of processing is not interfaced with the FA

of accounting transactions module and xed assets register

outside IT system on the is maintained in excel. However,

integrity of the accounts the nal effect is taken in the FA

along with the nancial module through separate

implications, if any, may be accounting transaction.

stated.

2 Whether there is any During the year there is no There is no impact on the

restructuring of an existing restructuring of existing loan, nor Accounts and Standalone

l o a n o r c a s e s o f cases of waiver and write off of Financial Statement.

waiver/write off of debts debts /loan or interest by the

/loans/interest etc. made by lender to the company due to

a lender to the company company's inability to repay the

due to the company's loan.

inability to repay the loan? If

yes, the nancial impact

may be stated.

125