Page 139 - KRCL ENglish

P. 139

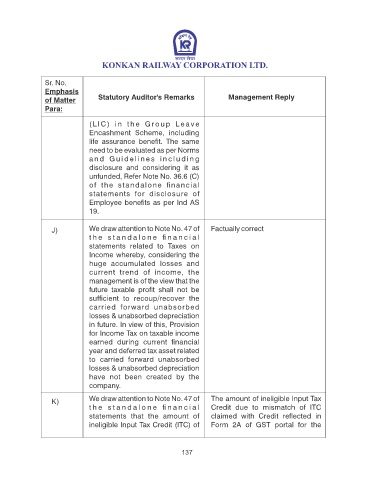

Sr. No.

Emphasis

of Matter Statutory Auditor's Remarks Management Reply

Para:

( L I C ) i n t h e G r o u p L e a v e

Encashment Scheme, including

life assurance benet. The same

need to be evaluated as per Norms

a n d G u i d e l i n e s i n c l u d i n g

disclosure and considering it as

unfunded, Refer Note No. 36.6 (C)

of the standalone nancial

statements for disclosure of

Employee benets as per Ind AS

19.

J) We draw attention to Note No. 47 of Factually correct

t h e s t a n d a l o n e n a n c i a l

statements related to Taxes on

Income whereby, considering the

huge accumulated losses and

current trend of income, the

management is of the view that the

future taxable prot shall not be

sufcient to recoup/recover the

carried forward unabsorbed

losses & unabsorbed depreciation

in future. In view of this, Provision

for Income Tax on taxable income

earned during current nancial

year and deferred tax asset related

to carried forward unabsorbed

losses & unabsorbed depreciation

have not been created by the

company.

We draw attention to Note No. 47 of The amount of ineligible Input Tax

K)

t h e s t a n d a l o n e n a n c i a l Credit due to mismatch of ITC

statements that the amount of claimed with Credit reected in

ineligible Input Tax Credit (ITC) of Form 2A of GST portal for the

137