Page 140 - KRCL ENglish

P. 140

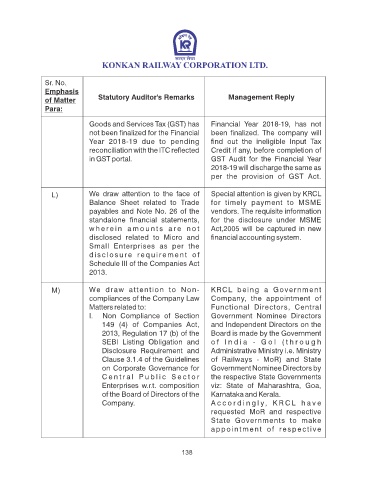

Sr. No.

Emphasis

of Matter Statutory Auditor's Remarks Management Reply

Para:

Goods and Services Tax (GST) has Financial Year 2018-19, has not

not been nalized for the Financial been nalized. The company will

Year 2018-19 due to pending nd out the ineligible Input Tax

reconciliation with the ITC reected Credit if any, before completion of

in GST portal. GST Audit for the Financial Year

2018-19 will discharge the same as

per the provision of GST Act.

L) We draw attention to the face of Special attention is given by KRCL

Balance Sheet related to Trade for timely payment to MSME

payables and Note No. 26 of the vendors. The requisite information

standalone nancial statements, for the disclosure under MSME

w h e r e i n a m o u n t s a r e n o t Act,2005 will be captured in new

disclosed related to Micro and nancial accounting system.

Small Enterprises as per the

disclosure requirement of

Schedule III of the Companies Act

2013.

M) We draw attention to Non- KRCL being a Government

compliances of the Company Law Company, the appointment of

Matters related to: Functional Directors, Central

I. Non Compliance of Section Government Nominee Directors

149 (4) of Companies Act, and Independent Directors on the

2013, Regulation 17 (b) of the Board is made by the Government

SEBI Listing Obligation and o f I n d i a - G o I ( t h r o u g h

Disclosure Requirement and Administrative Ministry i.e. Ministry

Clause 3.1.4 of the Guidelines of Railways - MoR) and State

on Corporate Governance for Government Nominee Directors by

C e n t r a l P u b l i c S e c t o r the respective State Governments

Enterprises w.r.t. composition viz: State of Maharashtra, Goa,

of the Board of Directors of the Karnataka and Kerala.

Company. A c c o r d i n g l y, K R C L h a v e

requested MoR and respective

State Governments to make

appointment of respective

138