Page 147 - KRCL ENglish

P. 147

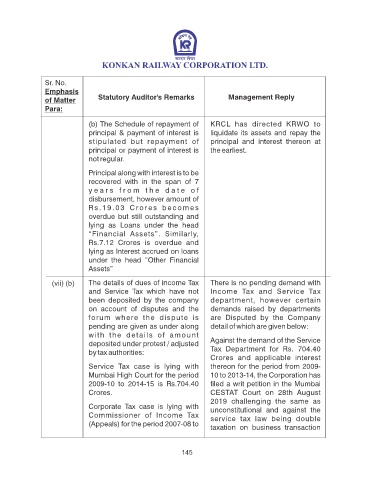

Sr. No.

Emphasis

of Matter Statutory Auditor's Remarks Management Reply

Para:

(b) The Schedule of repayment of KRCL has directed KRWO to

principal & payment of interest is liquidate its assets and repay the

stipulated but repayment of principal and interest thereon at

principal or payment of interest is the earliest.

not regular.

Principal along with interest is to be

recovered with in the span of 7

y e a r s f r o m t h e d a t e o f

disbursement, however amount of

Rs.19.03 Crores becomes

overdue but still outstanding and

lying as Loans under the head

“Financial Assets”. Similarly,

Rs.7.12 Crores is overdue and

lying as Interest accrued on loans

under the head “Other Financial

Assets”

(vii) (b) The details of dues of income Tax There is no pending demand with

and Service Tax which have not Income Tax and Service Tax

been deposited by the company department, however certain

on account of disputes and the demands raised by departments

forum where the dispute is are Disputed by the Company

pending are given as under along detail of which are given below:

with the details of amount

deposited under protest / adjusted Against the demand of the Service

by tax authorities: Tax Department for Rs. 704.40

Crores and applicable interest

Service Tax case is lying with thereon for the period from 2009-

Mumbai High Court for the period 10 to 2013-14, the Corporation has

2009-10 to 2014-15 is Rs.704.40 led a writ petition in the Mumbai

Crores. CESTAT Court on 28th August

2019 challenging the same as

Corporate Tax case is lying with unconstitutional and against the

Commissioner of Income Tax service tax law being double

(Appeals) for the period 2007-08 to

taxation on business transaction

145