Page 148 - KRCL ENglish

P. 148

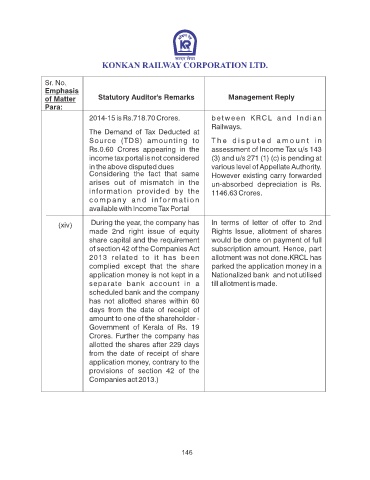

Sr. No.

Emphasis

of Matter Statutory Auditor's Remarks Management Reply

Para:

2014-15 is Rs.718.70 Crores. between KRCL and Indian

Railways.

The Demand of Tax Deducted at

Source (TDS) amounting to T h e d i s p u t e d a m o u n t i n

Rs.0.60 Crores appearing in the assessment of Income Tax u/s 143

income tax portal is not considered (3) and u/s 271 (1) (c) is pending at

in the above disputed dues various level of Appellate Authority.

Considering the fact that same However existing carry forwarded

arises out of mismatch in the un-absorbed depreciation is Rs.

information provided by the 1146.63 Crores.

c o m p a n y a n d i n f o r m a t i o n

available with Income Tax Portal

During the year, the company has In terms of letter of offer to 2nd

(xiv)

made 2nd right issue of equity Rights Issue, allotment of shares

share capital and the requirement would be done on payment of full

of section 42 of the Companies Act subscription amount. Hence, part

2013 related to it has been allotment was not done.KRCL has

complied except that the share parked the application money in a

application money is not kept in a Nationalized bank and not utilised

separate bank account in a till allotment is made.

scheduled bank and the company

has not allotted shares within 60

days from the date of receipt of

amount to one of the shareholder -

Government of Kerala of Rs. 19

Crores. Further the company has

allotted the shares after 229 days

from the date of receipt of share

application money, contrary to the

provisions of section 42 of the

Companies act 2013.)

146