Page 292 - KRCL ENglish

P. 292

st

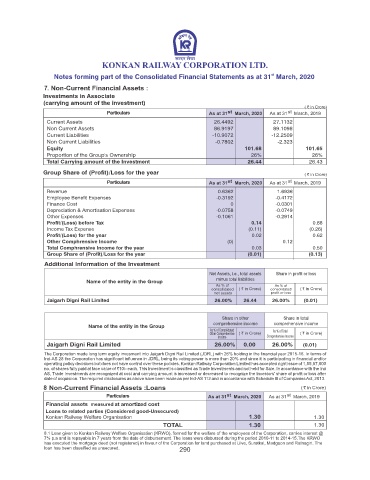

Notes forming part of the Consolidated Financial Statements as at 31 March, 2020

Investments in Associate

(carrying amount of the investment)

2019

Current Assets 26.4492 27.1132

Non Current Assets 86.9197 89.1098

Current Liabilities -10.9072 -12.2509

Non Current Liabilities -0.7802 -2.323

Equity 101.68 101.65

Proportion of the Group's Ownership 26% 26%

Total Carrying amount of the Investment 26.44 26.43

Group Share of (Prot)/Loss for the year

2019

Revenue 0.6362 1.6936

Employee Benet Expenses -0.3192 -0.4172

Finance Cost 0 -0.0301

Depreciation & Amortisation Expenses -0.0758 -0.0749

Other Expenses -0.1061 -0.2914

Prot/(Loss) before Tax 0.14 0.88

Income Tax Expense (0.11) (0.26)

Prot/(Loss) for the year 0.02 0.62

Other Comphrensive Income (0) 0.12

Total Comphrensive Income for the year 0.03 0.50

Group Share of (Prot)/Loss for the year (0.01) (0.13)

Additional Information of the Investment

Net Assets, i.e., total assets Share in prot or loss

minus total liabilities

Name of the entity in the Group

As % of As % of

consolidated ( ` in Crore) consolidated ( ` in Crore)

net assets prot or loss

Jaigarh Digni Rail Limited 26.00% 26.44 26.00% (0.01)

Share in other Share in total

comprehensive income comprehensive income

Name of the entity in the Group

As % of Consolidated As % of Total

Other Comprehensive ( ` in Crore) ( ` in Crore)

Income Comprehensive Income

Jaigarh Digni Rail Limited 26.00% 0.00 26.00% (0.01)

The Corporation made long term equity invesment into Jaigarh Digni Rail Limited (JDRL) with 26% holding in the nancial year 2015-16. In terms of

Ind-AS 28 the Corporation has signicant inuence in JDRL, being its voting power is more than 20% and since it is participating in nancial and/or

operating policy decisions but does not have control over these policies. Konkan Railway Corporation Limited has accepted right issue of 1,55,87,000

no. of shares fully paid at face value of `10/- each. This Investment is classied as Trade Investments and not held for Sale. In accordance with the Ind

AS, Trade Investments are recognized at cost and carrying amount is increased or decreased to recognize the Investors' share of prot or loss after

date of acquisiion. The required disclosures as above have been made as per Ind-AS 112 and in accordance with Schedule III of Companies Act, 2013.

2019

measured

1.30

1.30

8.1 Loan given to Konkan Railway Welfare Organisation (KRWO), formed for the welfare of the employees of the Corporation, carries interest @

7% p.a and is repayable in 7 years from the date of disbursement. The loans were disbursed during the period 2010-11 to 2014-15.The KRWO

has executed the mortgage deed (not registered) in favour of the Corporation for land purchased at Ulve, Suratkal, Madgaon and Ratnagiri. The

loan has been classied as unsecured. 290