Page 32 - P4304.1-V96_PS-Magazine-April 2024

P. 32

Just what is the PA Allowance?

A practice is unable to claim VAT back (from the HMRC) on the items that are

administered in practice or by a practice member of staff in the home of a patient.

In order to compensate the practice for this, the NHS Prescription Services

calculate 20% of the value of PA Items each month to cover the lost VAT.

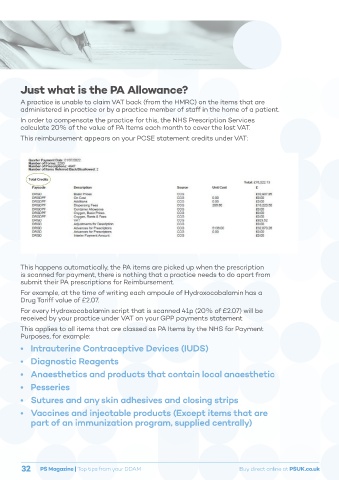

This reimbursement appears on your PCSE statement credits under VAT:

This happens automatically, the PA items are picked up when the prescription

is scanned for payment, there is nothing that a practice needs to do apart from

submit their PA prescriptions for Reimbursement.

For example, at the time of writing each ampoule of Hydroxocobalamin has a

Drug Tariff value of £2.07.

For every Hydroxocobalamin script that is scanned 41p (20% of £2.07) will be

received by your practice under VAT on your GPP payments statement

This applies to all items that are classed as PA Items by the NHS for Payment

Purposes, for example:

• Intrauterine Contraceptive Devices (IUDS)

• Diagnostic Reagents

• Anaesthetics and products that contain local anaesthetic

• Pesseries

• Sutures and any skin adhesives and closing strips

• Vaccines and injectable products (Except items that are

part of an immunization program, supplied centrally)

32 PS Magazine | Top tips from your DDAM Buy direct online at PSUK.co.uk