Page 13 - P4403.14_V91_YOUROTC_Book APRIL_2024_PRINT

P. 13

IN THE KNOW: ALLERGY 13

OWN BRAND 13

Allergy Brand Performance

2023

Allergy Brand Performance

Sponsored by

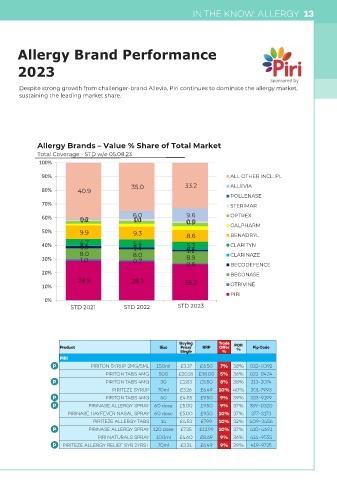

Despite strong growth from challenger-brand Allevia, Piri continues to dominate the allergy market,

2023

sustaining the leading market share.

Allergy Brands – Value % Share of Total Market

Total Coverage - STD w/e 05.08.23 Sponsored by

100% Despite strong growth from challenger-brand Allevia, Piri continues to dominate the allergy market,

90% sustaining the leading market share. ALL OTHER INCL. PL

33.2

ALLEVIA

35.0

80% Allergy Brands – Value % Share of Total Market

40.9

POLLENASE

70% Total Coverage - STD w/e 05.08.23 STERIMAR

100%

9.6

60% 0.2 6.0 0.0 OPTREX

-

0.1

1.0

1.0

0.9

50% 90% 9.9 9.3 8.6 GALPHARM ALL OTHER INCL. PL

BENADRYL

33.2

5.3

0.4

40% 80% 4.7 40.9 5.4 35.0 CLARITYN ALLEVIA

1.6

0.4

1.4

0.4

8.0 8.0 1.2 CLARINAZE POLLENASE

30% 1.0 0.7 8.9

70% 0.6 BECODEFENCE STERIMAR

20% BECONASE

60% 28.9 0.2 28.3 6.0 9.6 OPTREX

0.1

-

1.0

1.0

26.2

0.0

0.9

10% OTRIVINE GALPHARM

50% PIRI

0% 9.9 9.3 8.6 BENADRYL

STD 2021 STD 2022 STD 2023

STD 2YA

STD YA

STD TY

40% 4.7 5.4 5.3 CLARITYN

0.4

0.4

1.6

1.4

0.4

8.0 8.0 1.2 CLARINAZE

8.9

The Peak period continues to gain importance, accounting for 62% of the season’s sales, while the

30%

1.0

post peak period is losing importance. 0.7 0.6 BECODEFENCE

20%

Allergy – Value % Share of Allergy BECONASE

28.9

28.3

Total Coverage - STD split years by peaks w/e 05.08.2023 26.2 OTRIVINE

10%

31.5 29.2 29.3 60.9 62.6 PIRI

0% 56.8 11.7 9.9

STD 2021 STD 2022 STD 2023 8.1

STD YA

STD TY

STD 2YA

The Peak period continues to gain importance, accounting for 62% of the season’s sales, while the

post peak period is losing importance.

Pre-Peak 2YAPre-Peak YAPre-Peak TY Peak 2YA Peak YA Peak TY Post Peak Post Peak YAPost Peak TY

2YA

Buying Trade POR

Product

Size

Allergy – Value % Share of Allergy Price/ RRP Offer % Pip Code

%

Single

This year, syrup supply constraints held back growth in the Kids segment. Despite this, Piri syrups

Total Coverage - STD split years by peaks w/e 05.08.2023

PIRI

continue to dominate the Kids segment.

PIRITON SYRUP 2MG/5ML 150ml £3.37 £6.50 7% 38% 022-0392

Kids and Adults – Value and Unit Sales 500 £20.26 £38.00 60.9 36% 022-0434

31.5

62.6

PIRITON TABS 4MG

5%

29.2

29.3

Total Coverage - STD TY, YA, 2YA w/e 05.08.23 30 56.8 £5.50 8% 38% 213-2074 11.7 9.9

PIRITON TABS 4MG

£2.83

PIRITEZE SYRUP 70ml £3.26 £6.49 10% 40% 301-7993 8.1

8.5% PIRITON TABS 4MG 60 91.5% £9.50 9% 39% 333-9199

£4.85

£5.00

PIRINASE ALLERGY SPRAY 60 dose

-0.3%pts +0.3% £9.50 9% 37% 359-0320

PIRINASE HAYFEVER NASAL SPRAY 60 dose £5.00 £9.50 10% 37% 377-3173

£7.99

KIDS - Value Sales £m 14 £4.53 KIDS - Unit Sales (m) Post Peak Post Peak YAPost Peak TY

PIRITEZE ALLERGY TABS

409-3456

10% 32%

Pre-Peak 2YAPre-Peak YAPre-Peak TY Peak 2YA £13.99 10% 37% Peak TY

Peak YA

410-4691

PIRINASE ALLERGY SPRAY 120 dose

£7.35

£10.4m £10.1m 2.1m 2YA

1.8m

1.7m

£8.1m PIRI NATURALS SPRAY 100ml £4.60 £8.69 9% 36% 414-9555

This year, syrup supply constraints held back growth in the Kids segment. Despite this, Piri syrups

PIRITEZE ALLERGY RELIEF SYR 2YRS+

39%

70ml

9%

£6.49

419-9725

£3.31

continue to dominate the Kids segment.

+27.7% -2.4% +24.0% -10.7%

Kids and Adults – Value and Unit Sales

STD 2YA STD YA STD TY STD 2YA STD YA STD TY

Total Coverage - STD TY, YA, 2YA w/e 05.08.23

8.5% 91.5%

-0.3%pts +0.3%

KIDS - Value Sales £m KIDS - Unit Sales (m)

£10.4m £10.1m 2.1m

£8.1m 1.7m 1.8m

+27.7% -2.4% +24.0% -10.7%

STD 2YA STD YA STD TY STD 2YA STD YA STD TY