Page 40 - P4304.1-V110 PSUK Mag June 2025

P. 40

Will the Employment Allowance help?

To offset some of these increased costs, the government announced that the

Employment Allowance will increase from £5,000 to £10,500. This allowance

enables eligible businesses to reduce their NIC bill by up to £10,500 per year,

offering some relief to smaller employers.

At present, if employers incur an NIC liability of greater than £100,000 then they

can’t claim Employment Allowance (EA). From 6 April 2025 this cap will be removed.

However, this does not fully negate the impact of the NIC increase for many

businesses, particularly those with larger payrolls.

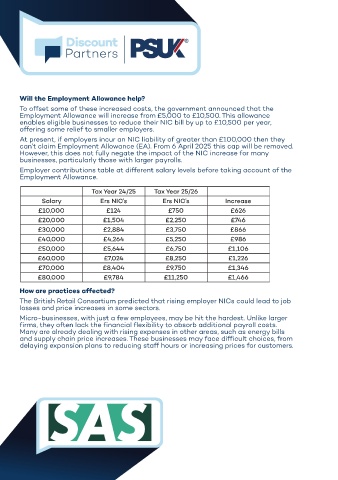

Employer contributions table at different salary levels before taking account of the

Employment Allowance.

Tax Year 24/25 Tax Year 25/26

Salary Ers NIC’s Ers NIC’s Increase

£10,000 £124 £750 £626

£20,000 £1,504 £2,250 £746

£30,000 £2,884 £3,750 £866

£40,000 £4,264 £5,250 £986

£50,000 £5,644 £6,750 £1,106

£60,000 £7,024 £8,250 £1,226

£70,000 £8,404 £9,750 £1,346

£80,000 £9,784 £11,250 £1,466

How are practices affected?

The British Retail Consortium predicted that rising employer NICs could lead to job

losses and price increases in some sectors.

Micro-businesses, with just a few employees, may be hit the hardest. Unlike larger

firms, they often lack the financial flexibility to absorb additional payroll costs.

Many are already dealing with rising expenses in other areas, such as energy bills

and supply chain price increases. These businesses may face difficult choices, from

delaying expansion plans to reducing staff hours or increasing prices for customers.

40

20/05/2025 15:39:28

P4304.1-V110 PSUK Mag June 2025.indd 40 20/05/2025 15:39:28

P4304.1-V110 PSUK Mag June 2025.indd 40