Page 258 - Theoretical and Practical Interpretation of Investment Attractiveness

P. 258

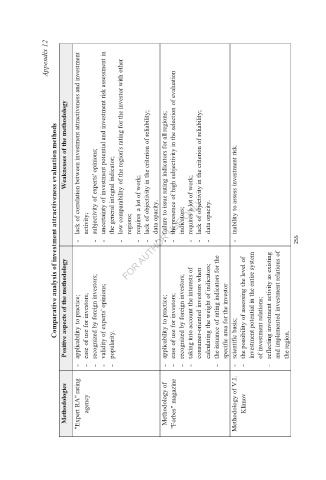

Appendix 12

Weaknesses of the methodology lack of correlation between investment attractiveness and investment uncertainty of investment potential and investment risk assessment in low comparability of the region's rating for the investor with other lack of objectivity in the criterion of reliability; failure to issue rating i

Comparative analysis of investment attractiveness evaluation methods

activity; subjectivity of experts' opinions; the general integral indicator; regions; requires a lot of work; data opacity. indicators; requires a lot of work; data opacity. inability to assess investment risk.

˗ ˗ ˗ ˗ ˗ ˗ ˗ ˗ ˗ ˗ ˗ ˗ ˗ 255

Positive aspects of the methodology applicability to practice; ease of use for investors; recognized by foreign investors; validity of experts' opinions; applicability to practice; ease of use for investors; recognized by foreign investors; taking into account the interests of consumer-oriented investors when

˗ ˗ ˗ ˗ popularity. ˗ ˗ ˗ ˗ ˗ ˗ scientific basis; ˗ ˗ ˗ the region.

Methodologies "Expert RA" rating agency Methodology of "Forbes" magazine Methodology of V.I. Klimov