Page 6 - Shore Chan DePumpo - Dallas CBD Market Overview

P. 6

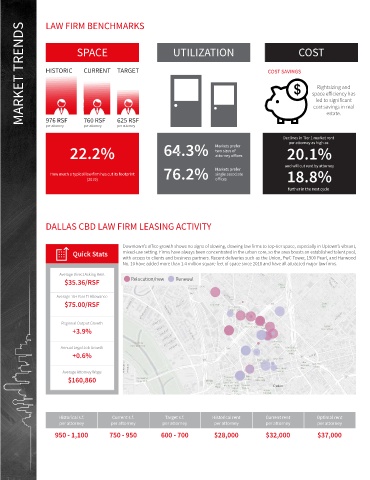

MARKET TRENDS LAW FIRM BENCHMARKS UTILIZATION COST SAVINGS COST

SPACE

HISTORIC

CURRENT

TARGET

Rightsizing and

space efficiency has

led to significant

cost savings in real

estate.

760 RSF

976 RSF

625 RSF

per attorney

per attorney

per attorney

Declines in Tier 1 market rent

per attorney as high as

22.2% 64.3% Markets prefer 20.1%

two sizes of

attorney offices

76.2% Markets prefer and will cut rent by attorney

How much a typical law firm has cut its footprint single associate 18.8%

(2019) offices

further in the next cycle

DALLAS CBD LAW FIRM LEASING ACTIVITY

Downtown’s office growth shows no signs of slowing, drawing law firms to top-tier space, especially in Uptown’s vibrant,

Quick Stats mixed-use setting. Firms have always been concentrated in the urban core, so the area boasts an established talent pool,

with access to clients and business partners. Recent deliveries such as the Union, PwC Tower, 1900 Pearl, and Harwood

No. 10 have added more than 1.4 million square feet of space since 2018 and have all attracted major law firms.

Average Direct Asking Rent

$35.36/RSF Relocation/new Renewal

Average 10+ Year TI Allowance

$75.00/RSF

Regional Output Growth

+3.9%

Annual Legal Job Growth

+0.6%

Average Attorney Wage

$160,860

Historical s.f. Current s.f. Target s.f. Historical rent Current rent Optimal rent

per attorney per attorney per attorney per attorney per attorney per attorney

950 - 1,100 750 - 950 600 - 700 $28,000 $32,000 $37,000