Page 44 - DBP5043

P. 44

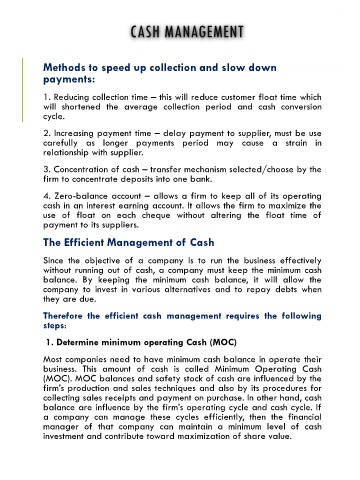

CASH MANAGEMENT

Methods to speed up collection and slow down

payments:

1. Reducing collection time – this will reduce customer float time which

will shortened the average collection period and cash conversion

cycle.

2. Increasing payment time – delay payment to supplier, must be use

carefully as longer payments period may cause a strain in

relationship with supplier.

3. Concentration of cash – transfer mechanism selected/choose by the

firm to concentrate deposits into one bank.

4. Zero-balance account – allows a firm to keep all of its operating

cash in an interest earning account. It allows the firm to maximize the

use of float on each cheque without altering the float time of

payment to its suppliers.

The Efficient Management of Cash

Since the objective of a company is to run the business effectively

without running out of cash, a company must keep the minimum cash

balance. By keeping the minimum cash balance, it will allow the

company to invest in various alternatives and to repay debts when

they are due.

Therefore the efficient cash management requires the following

steps:

1. Determine minimum operating Cash (MOC)

Most companies need to have minimum cash balance in operate their

business. This amount of cash is called Minimum Operating Cash

(MOC). MOC balances and safety stock of cash are influenced by the

firm’s production and sales techniques and also by its procedures for

collecting sales receipts and payment on purchase. In other hand, cash

balance are influence by the firm’s operating cycle and cash cycle. If

a company can manage these cycles efficiently, then the financial

manager of that company can maintain a minimum level of cash

investment and contribute toward maximization of share value.