Page 39 - DBP5043

P. 39

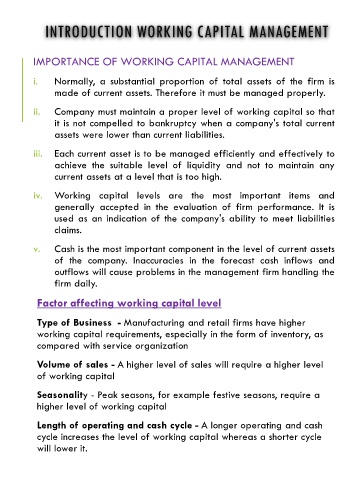

INTRODUCTION WORKING CAPITAL MANAGEMENT

IMPORTANCE OF WORKING CAPITAL MANAGEMENT

i. Normally, a substantial proportion of total assets of the firm is

made of current assets. Therefore it must be managed properly.

ii. Company must maintain a proper level of working capital so that

it is not compelled to bankruptcy when a company's total current

assets were lower than current liabilities.

iii. Each current asset is to be managed efficiently and effectively to

achieve the suitable level of liquidity and not to maintain any

current assets at a level that is too high.

iv. Working capital levels are the most important items and

generally accepted in the evaluation of firm performance. It is

used as an indication of the company's ability to meet liabilities

claims.

v. Cash is the most important component in the level of current assets

of the company. Inaccuracies in the forecast cash inflows and

outflows will cause problems in the management firm handling the

firm daily.

Factor affecting working capital level

Type of Business - Manufacturing and retail firms have higher

working capital requirements, especially in the form of inventory, as

compared with service organization

Volume of sales - A higher level of sales will require a higher level

of working capital

Seasonality - Peak seasons, for example festive seasons, require a

higher level of working capital

Length of operating and cash cycle - A longer operating and cash

cycle increases the level of working capital whereas a shorter cycle

will lower it.