Page 97 - DBP5043

P. 97

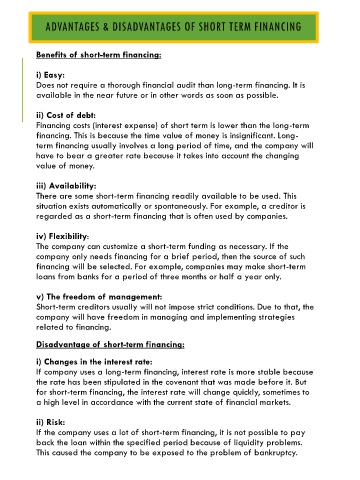

ADVANTAGES & DISADVANTAGES OF SHORT TERM FINANCING

Benefits of short-term financing:

i) Easy:

Does not require a thorough financial audit than long-term financing. It is

available in the near future or in other words as soon as possible.

ii) Cost of debt:

Financing costs (interest expense) of short term is lower than the long-term

financing. This is because the time value of money is insignificant. Long-

term financing usually involves a long period of time, and the company will

have to bear a greater rate because it takes into account the changing

value of money.

iii) Availability:

There are some short-term financing readily available to be used. This

situation exists automatically or spontaneously. For example, a creditor is

regarded as a short-term financing that is often used by companies.

iv) Flexibility:

The company can customize a short-term funding as necessary. If the

company only needs financing for a brief period, then the source of such

financing will be selected. For example, companies may make short-term

loans from banks for a period of three months or half a year only.

v) The freedom of management:

Short-term creditors usually will not impose strict conditions. Due to that, the

company will have freedom in managing and implementing strategies

related to financing.

Disadvantage of short-term financing:

i) Changes in the interest rate:

If company uses a long-term financing, interest rate is more stable because

the rate has been stipulated in the covenant that was made before it. But

for short-term financing, the interest rate will change quickly, sometimes to

a high level in accordance with the current state of financial markets.

ii) Risk:

If the company uses a lot of short-term financing, it is not possible to pay

back the loan within the specified period because of liquidity problems.

This caused the company to be exposed to the problem of bankruptcy.