Page 102 - DBP5043

P. 102

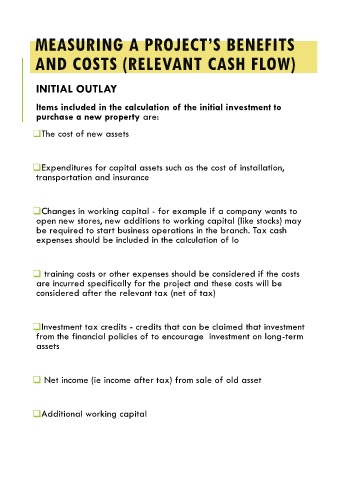

MEASURING A PROJECT’S BENEFITS

AND COSTS (RELEVANT CASH FLOW)

INITIAL OUTLAY

Items included in the calculation of the initial investment to

purchase a new property are:

The cost of new assets

Expenditures for capital assets such as the cost of installation,

transportation and insurance

Changes in working capital - for example if a company wants to

open new stores, new additions to working capital (like stocks) may

be required to start business operations in the branch. Tax cash

expenses should be included in the calculation of Io

training costs or other expenses should be considered if the costs

are incurred specifically for the project and these costs will be

considered after the relevant tax (net of tax)

Investment tax credits - credits that can be claimed that investment

from the financial policies of to encourage investment on long-term

assets

Net income (ie income after tax) from sale of old asset

Additional working capital