Page 107 - DBP5043

P. 107

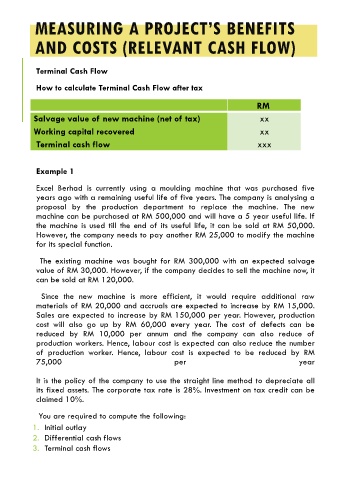

MEASURING A PROJECT’S BENEFITS

AND COSTS (RELEVANT CASH FLOW)

Terminal Cash Flow

How to calculate Terminal Cash Flow after tax

RM

Salvage value of new machine (net of tax) xx

Working capital recovered xx

Terminal cash flow xxx

Example 1

Excel Berhad is currently using a moulding machine that was purchased five

years ago with a remaining useful life of five years. The company is analysing a

proposal by the production department to replace the machine. The new

machine can be purchased at RM 500,000 and will have a 5 year useful life. If

the machine is used till the end of its useful life, it can be sold at RM 50,000.

However, the company needs to pay another RM 25,000 to modify the machine

for its special function.

The existing machine was bought for RM 300,000 with an expected salvage

value of RM 30,000. However, if the company decides to sell the machine now, it

can be sold at RM 120,000.

Since the new machine is more efficient, it would require additional raw

materials of RM 20,000 and accruals are expected to increase by RM 15,000.

Sales are expected to increase by RM 150,000 per year. However, production

cost will also go up by RM 60,000 every year. The cost of defects can be

reduced by RM 10,000 per annum and the company can also reduce of

production workers. Hence, labour cost is expected can also reduce the number

of production worker. Hence, labour cost is expected to be reduced by RM

75,000 per year

It is the policy of the company to use the straight line method to depreciate all

its fixed assets. The corporate tax rate is 28%. Investment on tax credit can be

claimed 10%.

You are required to compute the following:

1. Initial outlay

2. Differential cash flows

3. Terminal cash flows