Page 104 - DBP5043

P. 104

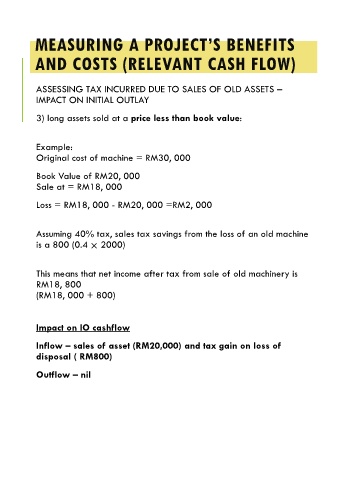

MEASURING A PROJECT’S BENEFITS

AND COSTS (RELEVANT CASH FLOW)

ASSESSING TAX INCURRED DUE TO SALES OF OLD ASSETS –

IMPACT ON INITIAL OUTLAY

3) long assets sold at a price less than book value:

Example:

Original cost of machine = RM30, 000

Book Value of RM20, 000

Sale at = RM18, 000

Loss = RM18, 000 - RM20, 000 =RM2, 000

Assuming 40% tax, sales tax savings from the loss of an old machine

is a 800 (0.4 × 2000)

This means that net income after tax from sale of old machinery is

RM18, 800

(RM18, 000 + 800)

Impact on IO cashflow

Inflow – sales of asset (RM20,000) and tax gain on loss of

disposal ( RM800)

Outflow – nil