Page 109 - DBP5043

P. 109

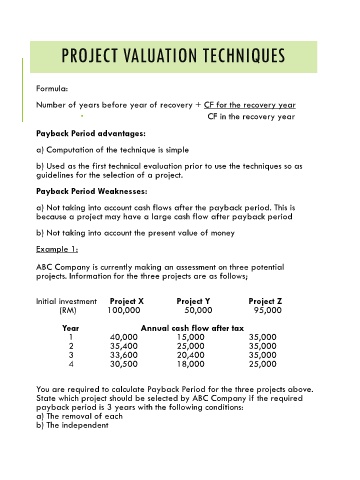

PROJECT VALUATION TECHNIQUES

Formula:

Number of years before year of recovery + CF for the recovery year

CF in the recovery year

Payback Period advantages:

a) Computation of the technique is simple

b) Used as the first technical evaluation prior to use the techniques so as

guidelines for the selection of a project.

Payback Period Weaknesses:

a) Not taking into account cash flows after the payback period. This is

because a project may have a large cash flow after payback period

b) Not taking into account the present value of money

Example 1:

ABC Company is currently making an assessment on three potential

projects. Information for the three projects are as follows;

Initial investment Project X Project Y Project Z

(RM) 100,000 50,000 95,000

Year Annual cash flow after tax

1 40,000 15,000 35,000

2 35,400 25,000 35,000

3 33,600 20,400 35,000

4 30,500 18,000 25,000

You are required to calculate Payback Period for the three projects above.

State which project should be selected by ABC Company if the required

payback period is 3 years with the following conditions:

a) The removal of each

b) The independent