Page 106 - DBP5043

P. 106

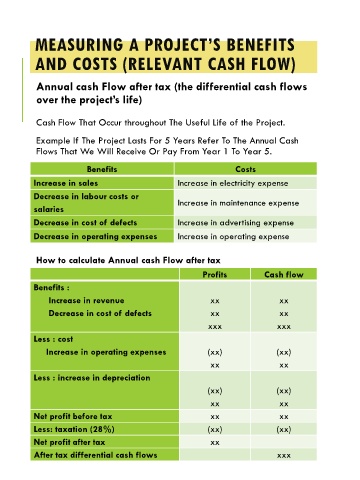

MEASURING A PROJECT’S BENEFITS

AND COSTS (RELEVANT CASH FLOW)

Annual cash Flow after tax (the differential cash flows

over the project’s life)

Cash Flow That Occur throughout The Useful Life of the Project.

Example If The Project Lasts For 5 Years Refer To The Annual Cash

Flows That We Will Receive Or Pay From Year 1 To Year 5.

Benefits Costs

Increase in sales Increase in electricity expense

Decrease in labour costs or Increase in maintenance expense

salaries

Decrease in cost of defects Increase in advertising expense

Decrease in operating expenses Increase in operating expense

How to calculate Annual cash Flow after tax

Profits Cash flow

Benefits :

Increase in revenue xx xx

Decrease in cost of defects xx xx

xxx xxx

Less : cost

Increase in operating expenses (xx) (xx)

xx xx

Less : increase in depreciation

(xx) (xx)

xx xx

Net profit before tax xx xx

Less: taxation (28%) (xx) (xx)

Net profit after tax xx

After tax differential cash flows xxx