Page 12 - NOT FOR SELL SIBUSISIWEFXupdate_Neat

P. 12

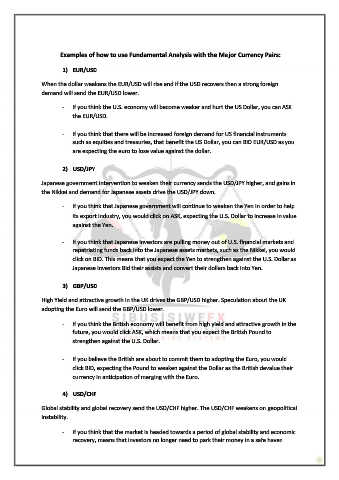

Examples of how to use Fundamental Analysis with the Major Currency Pairs:

1) EUR/USD

When the dollar weakens the EUR/USD will rise and if the USD recovers then a strong foreign

demand will send the EUR/USD lower.

- If you think the U.S. economy will become weaker and hurt the US Dollar, you can ASK

the EUR/USD.

- If you think that there will be increased foreign demand for US financial instruments

such as equities and treasuries, that benefit the US Dollar, you can BID EUR/USD as you

are expecting the euro to lose value against the dollar.

2) USD/JPY

Japanese government intervention to weaken their currency sends the USD/JPY higher, and gains in

the Nikkei and demand for Japanese assets drive the USD/JPY down.

- If you think that Japanese government will continue to weaken the Yen in order to help

its export industry, you would click on ASK, expecting the U.S. Dollar to increase in value

against the Yen.

- If you think that Japanese investors are pulling money out of U.S. financial markets and

repatriating funds back into the Japanese assets markets, such as the Nikkei, you would

click on BID. This means that you expect the Yen to strengthen against the U.S. Dollar as

Japanese investors Bid their assists and convert their dollars back into Yen.

3) GBP/USD

High Yield and attractive growth in the UK drives the GBP/USD higher. Speculation about the UK

adopting the Euro will send the GBP/USD lower.

- If you think the British economy will benefit from high yield and attractive growth in the

future, you would click ASK, which means that you expect the British Pound to

strengthen against the U.S. Dollar.

- If you believe the British are about to commit them to adopting the Euro, you would

click BID, expecting the Pound to weaken against the Dollar as the British devalue their

currency in anticipation of merging with the Euro.

4) USD/CHF

Global stability and global recovery send the USD/CHF higher. The USD/CHF weakens on geopolitical

instability.

- If you think that the market is headed towards a period of global stability and economic

recovery, means that investors no longer need to park their money in a safe haven