Page 187 - Krugmans Economics for AP Text Book_Neat

P. 187

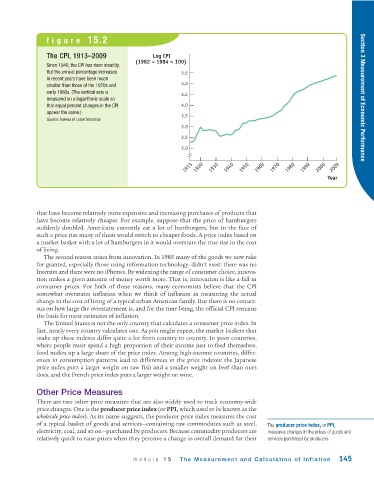

figure 15.2

The CPI, 1913–2009 Log CPI

(1982 – 1984 = 100)

Since 1940, the CPI has risen steadily.

But the annual percentage increases 5.5

in recent years have been much

smaller than those of the 1970s and 5.0

early 1980s. (The vertical axis is

4.5

measured on a logarithmic scale so Section 3 Measurement of Economic Performance

that equal percent changes in the CPI 4.0

appear the same.)

3.5

Source: Bureau of Labor Statistics.

3.0

2.5

2.0

1913 1920 1930 1940 1950 1960 1970 1980 1990 2000 2009

Year

that have become relatively more expensive and increasing purchases of products that

have become relatively cheaper. For example, suppose that the price of hamburgers

suddenly doubled. Americans currently eat a lot of hamburgers, but in the face of

such a price rise many of them would switch to cheaper foods. A price index based on

a market basket with a lot of hamburgers in it would overstate the true rise in the cost

of living.

The second reason arises from innovation. In 1985 many of the goods we now take

for granted, especially those using information technology, didn’t exist: there was no

Internet and there were no iPhones. By widening the range of consumer choice, innova-

tion makes a given amount of money worth more. That is, innovation is like a fall in

consumer prices. For both of these reasons, many economists believe that the CPI

somewhat overstates inflation when we think of inflation as measuring the actual

change in the cost of living of a typical urban American family. But there is no consen-

sus on how large the overstatement is, and for the time being, the official CPI remains

the basis for most estimates of inflation.

The United States is not the only country that calculates a consumer price index. In

fact, nearly every country calculates one. As you might expect, the market baskets that

make up these indexes differ quite a lot from country to country. In poor countries,

where people must spend a high proportion of their income just to feed themselves,

food makes up a large share of the price index. Among high -income countries, differ-

ences in consumption patterns lead to differences in the price indexes: the Japanese

price index puts a larger weight on raw fish and a smaller weight on beef than ours

does, and the French price index puts a larger weight on wine.

Other Price Measures

There are two other price measures that are also widely used to track economy - wide

price changes. One is the producer price index (or PPI, which used to be known as the

wholesale price index). As its name suggests, the producer price index measures the cost

of a typical basket of goods and services—containing raw commodities such as steel, The producer price index, or PPI,

electricity, coal, and so on—purchased by producers. Because commodity producers are measures changes in the prices of goods and

relatively quick to raise prices when they perceive a change in overall demand for their services purchased by producers.

module 15 The Measurement and Calculation of Inflation 145