Page 188 - Krugmans Economics for AP Text Book_Neat

P. 188

goods, the PPI often responds to inflationary or deflationary pressures more quickly

The GDP deflator for a given year is 100

than the CPI. As a result, the PPI is often regarded as an “early warning signal” of

times the ratio of nominal GDP to real GDP in

changes in the inflation rate.

that year.

The other widely used price measure is the GDP deflator; it isn’t exactly a price index,

although it serves the same purpose. Recall how we distinguished between nominal

GDP (GDP in current prices) and real GDP (GDP calculated using the prices of a base

year). The GDP deflator for a given year is equal to 100 times the ratio of nominal

GDP for that year to real GDP for that year expressed in prices of a selected base year.

Since real GDP is currently expressed in 2005 dollars, the GDP deflator for 2005 is

equal to 100. If nominal GDP doubles but real GDP does not change, the GDP deflator

indicates that the aggregate price level doubled.

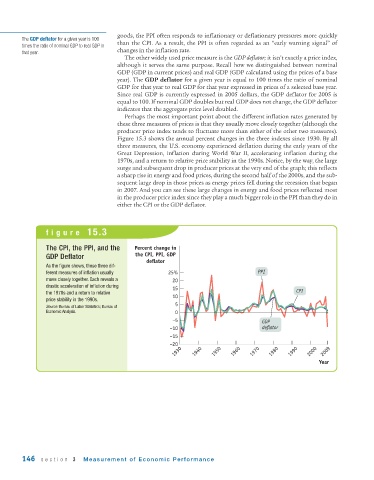

Perhaps the most important point about the different inflation rates generated by

these three measures of prices is that they usually move closely together (although the

producer price index tends to fluctuate more than either of the other two measures).

Figure 15.3 shows the annual percent changes in the three indexes since 1930. By all

three measures, the U.S. economy experienced deflation during the early years of the

Great Depression, inflation during World War II, accelerating inflation during the

1970s, and a return to relative price stability in the 1990s. Notice, by the way, the large

surge and subsequent drop in producer prices at the very end of the graph; this reflects

a sharp rise in energy and food prices, during the second half of the 2000s, and the sub-

sequent large drop in those prices as energy prices fell during the recession that began

in 2007. And you can see these large changes in energy and food prices reflected most

in the producer price index since they play a much bigger role in the PPI than they do in

either the CPI or the GDP deflator.

figure 15.3

The CPI, the PPI, and the Percent change in

GDP Deflator the CPI, PPI, GDP

deflator

As the figure shows, these three dif-

ferent measures of inflation usually 25% PPI

move closely together. Each reveals a 20

drastic acceleration of inflation during 15

the 1970s and a return to relative 10 CPI

price stability in the 1990s.

5

Source: Bureau of Labor Statistics; Bureau of

Economic Analysis. 0

–5 GDP

–10 deflator

–15

–20

1930 1940 1950 1960 1970 1980 1990 2000 2009

Year

146 section 3 Measurement of Economic Performance