Page 334 - Krugmans Economics for AP Text Book_Neat

P. 334

14. Although the U.S. Federal Reserve doesn’t use changes in re- 18. Use the market for loanable funds shown in the accompany-

serve requirements to manage the money supply, the central ing diagram to explain what happens to private savings, pri-

bank of Albernia does. The commercial banks of Albernia vate investment spending, and the rate of interest if the

have $100 million in reserves and $1,000 million in checkable following events occur. Assume that there are no capital in-

deposits; the initial required reserve ratio is 10%. The commer- flows or outflows.

cial banks follow a policy of holding no excess reserves. The

public holds no currency, only checkable deposits in the bank- Interest S

rate

ing system.

a. How will the money supply change if the required reserve

ratio falls to 5%?

b.How will the money supply change if the required reserve r 1 E

ratio rises to 25%?

15. Using Figure 26.1 find the Federal Reserve district in which

you live. Go to http://www.federalreserve.gov/bios/pres.

D

htm, and click on your district to identify the president

of the Federal Reserve Bank in your district. Go to

Q 1 Quantity of loanable funds

http://www.federalreserve.gov/fomc/ and determine if the

president of the Fed is currently a voting member of the Fed- a. The government reduces the size of its deficit to zero.

eral Open Market Committee (FOMC). b.At any given interest rate, consumers decide to save more.

16. The Congressional Research Service estimates that at least $45 Assume the budget balance is zero.

million of counterfeit U.S. $100 notes produced by the North c. At any given interest rate, businesses become very optimistic

Korean government are in circulation. about the future profitability of investment spending. As-

a. Why do U.S. taxpayers lose because of North Korea’s sume the budget balance is zero.

counterfeiting? 19. The government is running a budget balance of zero when it

b.As of September 2008, the interest rate earned on one- decides to increase education spending by $200 billion and

year U.S. Treasury bills was 2.2%. At a 2.2% rate of inter- finance the spending by selling bonds. The accompanying dia-

est, what is the amount of money U.S. taxpayers are gram shows the market for loanable funds before the govern-

losing per year because of these $45 million in ment sells the bonds. Assume that there are no capital inflows

counterfeit notes? or outflows. How will the equilibrium interest rate and the

equilibrium quantity of loanable funds change? Is there any

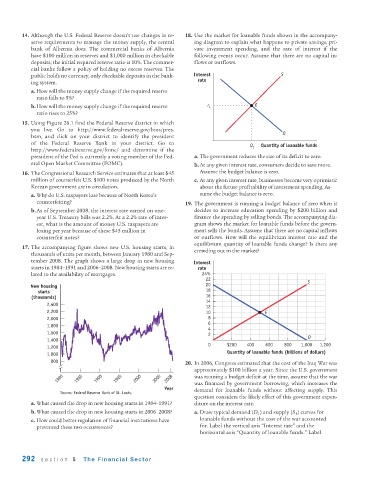

17. The accompanying figure shows new U.S. housing starts, in

crowding out in the market?

thousands of units per month, between January 1980 and Sep-

tember 2008. The graph shows a large drop in new housing Interest

starts in 1984–1991 and 2006–2008. New housing starts are re- rate

lated to the availability of mortgages. 24%

22

20 S

New housing

starts 18

(thousands) 16

2,400 14

12

2,200 10 E

2,000 8

6

1,800 4

1,600 2

1,400 D

0 $200 400 600 800 1,000 1,200

1,200

1,000 Quantity of loanable funds (billions of dollars)

800 20. In 2006, Congress estimated that the cost of the Iraq War was

approximately $100 billion a year. Since the U.S. government

1980 1985 1990 1995 2000 2005 2008 was running a budget deficit at the time, assume that the war

was financed by government borrowing, which increases the

Year demand for loanable funds without affecting supply. This

Source: Federal Reserve Bank of St. Louis.

question considers the likely effect of this government expen-

a. What caused the drop in new housing starts in 1984–1991? diture on the interest rate.

b.What caused the drop in new housing starts in 2006–2008? a. Draw typical demand (D 1 ) and supply (S 1 ) curves for

c. How could better regulation of financial institutions have loanable funds without the cost of the war accounted

prevented these two occurrences? for. Label the vertical axis “Interest rate” and the

horizontal axis “Quantity of loanable funds.” Label

292 section 5 The Financial Sector