Page 332 - Krugmans Economics for AP Text Book_Neat

P. 332

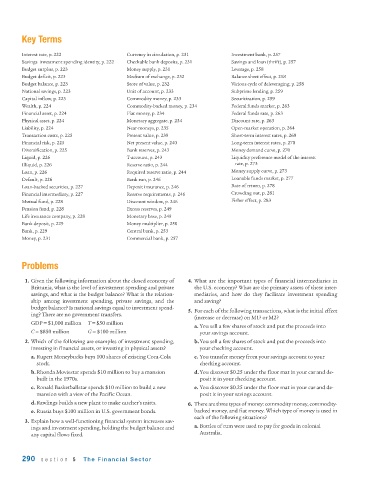

Key Terms

Interest rate, p. 222 Currency in circulation, p. 231 Investment bank, p. 257

Savings–investment spending identity, p. 222 Checkable bank deposits, p. 231 Savings and loan (thrift), p. 257

Budget surplus, p. 223 Money supply, p. 231 Leverage, p. 258

Budget deficit, p. 223 Medium of exchange, p. 232 Balance sheet effect, p. 258

Budget balance, p. 223 Store of value, p. 232 Vicious cycle of deleveraging, p. 258

National savings, p. 223 Unit of account, p. 233 Subprime lending, p. 259

Capital inflow, p. 223 Commodity money, p. 233 Securitization, p. 259

Wealth, p. 224 Commodity -backed money, p. 234 Federal funds market, p. 263

Financial asset, p. 224 Fiat money, p. 234 Federal funds rate, p. 263

Physical asset, p. 224 Monetary aggregate, p. 234 Discount rate, p. 263

Liability, p. 224 Near -moneys, p. 235 Open -market operation, p. 264

Transaction costs, p. 225 Present value, p. 239 Short-term interest rates, p. 269

Financial risk, p. 225 Net present value, p. 240 Long-term interest rates, p. 270

Diversification, p. 225 Bank reserves, p. 243 Money demand curve, p. 270

Liquid, p. 226 T-account, p. 243 Liquidity preference model of the interest

Illiquid, p. 226 Reserve ratio, p. 244 rate, p. 273

Loan, p. 226 Required reserve ratio, p. 244 Money supply curve, p. 273

Default, p. 226 Bank run, p. 246 Loanable funds market, p. 277

Loan-backed securities, p. 227 Deposit insurance, p. 246 Rate of return, p. 278

Financial intermediary, p. 227 Reserve requirements, p. 246 Crowding out, p. 281

Mutual fund, p. 228 Discount window, p. 246 Fisher effect, p. 283

Pension fund, p. 228 Excess reserves, p. 249

Life insurance company, p. 228 Monetary base, p. 249

Bank deposit, p. 229 Money multiplier, p. 250

Bank, p. 229 Central bank, p. 253

Money, p. 231 Commercial bank, p. 257

Problems

1. Given the following information about the closed economy of 4. What are the important types of financial intermediaries in

Brittania, what is the level of investment spending and private the U.S. economy? What are the primary assets of these inter-

savings, and what is the budget balance? What is the relation- mediaries, and how do they facilitate investment spending

ship among investment spending, private savings, and the and saving?

budget balance? Is national savings equal to investment spend- 5. For each of the following transactions, what is the initial effect

ing? There are no government transfers.

(increase or decrease) on M1? or M2?

GDP = $1,000 million T = $50 million

a. You sell a few shares of stock and put the proceeds into

C = $850 million G = $100 million your savings account.

2. Which of the following are examples of investment spending, b.You sell a few shares of stock and put the proceeds into

investing in financial assets, or investing in physical assets? your checking account.

a. Rupert Moneybucks buys 100 shares of existing Coca -Cola c. You transfer money from your savings account to your

stock. checking account.

b.Rhonda Moviestar spends $10 million to buy a mansion d.You discover $0.25 under the floor mat in your car and de-

built in the 1970s. posit it in your checking account.

c. Ronald Basketballstar spends $10 million to build a new e. You discover $0.25 under the floor mat in your car and de-

mansion with a view of the Pacific Ocean. posit it in your savings account.

d.Rawlings builds a new plant to make catcher’s mitts. 6. There are three types of money: commodity money, commodity -

e. Russia buys $100 million in U.S. government bonds. backed money, and fiat money. Which type of money is used in

each of the following situations?

3. Explain how a well-functioning financial system increases sav-

ings and investment spending, holding the budget balance and a. Bottles of rum were used to pay for goods in colonial

any capital flows fixed. Australia.

290 section 5 The Financial Sector