Page 328 - Krugmans Economics for AP Text Book_Neat

P. 328

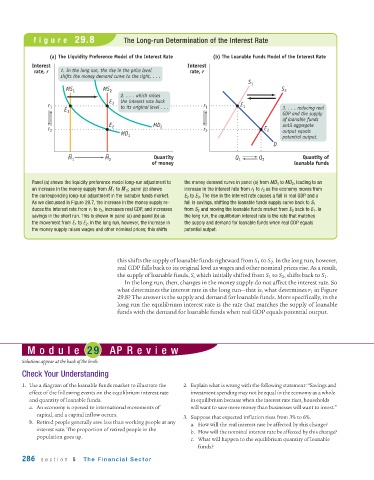

figure 29.8 The Long -run Determination of the Interest Rate

(a) The Liquidity Preference Model of the Interest Rate (b) The Loanable Funds Model of the Interest Rate

Interest Interest

rate, r 1. In the long run, the rise in the price level rate, r

shifts the money demand curve to the right, . . .

S 1

S

MS 1 MS 2 2

2. . . . which raises

E 3 the interest rate back

r 1 to its original level . . . r 1 E 1

E 1 3. . . . reducing real

GDP and the supply

of loanable funds

E 2 MD 2 until aggregate

r 2 r 2 E 2 output equals

MD 1 potential output.

D

M 1 M 2 Quantity Q 1 Q 2 Quantity of

of money loanable funds

Panel (a) shows the liquidity preference model long-run adjustment to the money demand curve in panel (a) from MD 1 to MD 2 , leading to an

–– ––

an increase in the money supply from M 1 to M 2 ; panel (b) shows increase in the interest rate from r 1 to r 2 as the economy moves from

the corresponding long-run adjustment in the loanable funds market. E 2 to E 3 . The rise in the interest rate causes a fall in real GDP and a

As we discussed in Figure 29.7, the increase in the money supply re- fall in savings, shifting the loanable funds supply curve back to S 1

duces the interest rate from r 1 to r 2 , increases real GDP, and increases from S 2 and moving the loanable funds market from E 2 back to E 1 . In

savings in the short run. This is shown in panel (a) and panel (b) as the long run, the equilibrium interest rate is the rate that matches

the movement from E 1 to E 2 . In the long run, however, the increase in the supply and demand for loanable funds when real GDP equals

the money supply raises wages and other nominal prices; this shifts potential output.

this shifts the supply of loanable funds rightward from S 1 to S 2 . In the long run, however,

real GDP falls back to its original level as wages and other nominal prices rise. As a result,

the supply of loanable funds, S, which initially shifted from S 1 to S 2 , shifts back to S 1 .

In the long run, then, changes in the money supply do not affect the interest rate. So

what determines the interest rate in the long run—that is, what determines r 1 in Figure

29.8? The answer is the supply and demand for loanable funds. More specifically, in the

long run the equilibrium interest rate is the rate that matches the supply of loanable

funds with the demand for loanable funds when real GDP equals potential output.

Module 29 AP Review

Solutions appear at the back of the book.

Check Your Understanding

1. Use a diagram of the loanable funds market to illustrate the 2. Explain what is wrong with the following statement: “Savings and

effect of the following events on the equilibrium interest rate investment spending may not be equal in the economy as a whole

and quantity of loanable funds. in equilibrium because when the interest rate rises, households

a. An economy is opened to international movements of will want to save more money than businesses will want to invest.”

capital, and a capital inflow occurs.

3. Suppose that expected inflation rises from 3% to 6%.

b. Retired people generally save less than working people at any

a. How will the real interest rate be affected by this change?

interest rate. The proportion of retired people in the

b. How will the nominal interest rate be affected by this change?

population goes up.

c. What will happen to the equilibrium quantity of loanable

funds?

286 section 5 The Financial Sector