Page 326 - Krugmans Economics for AP Text Book_Neat

P. 326

base their decisions on the expected real interest rate. As long as the level of inflation is

expected, it does not affect the equilibrium quantity of loanable funds or the expected

real interest rate; all it affects is the equilibrium nominal interest rate.

Reconciling the Two Interest Rate Models

In Module 28 we developed what is known as the liquidity preference model of the in-

terest rate. In that model, the equilibrium interest rate is the rate at which the quantity

of money demanded equals the quantity of money supplied. In the loanable funds

model, we see that the interest rate matches the quantity of loanable funds supplied by

savers with the quantity of loanable funds demanded for investment spending. How do

the two compare?

The Interest Rate in the Short Run

As we explained using the liquidity preference model, a fall in the interest rate leads to

a rise in investment spending, I, which then leads to a rise in both real GDP and con-

sumer spending, C. The rise in real GDP doesn’t lead only to a rise in consumer spend-

ing, however. It also leads to a rise in savings: at each stage of the multiplier process,

part of the increase in disposable income is saved. How much do savings rise? Accord-

ing to the savings–investment spending identity, total savings in the economy is always

equal to investment spending. This tells us that when a fall in the interest rate leads to

higher investment spending, the resulting increase in real GDP generates exactly

enough additional savings to match the rise in investment spending. To put it another

way, after a fall in the interest rate, the quantity of savings supplied rises exactly

enough to match the quantity of savings demanded.

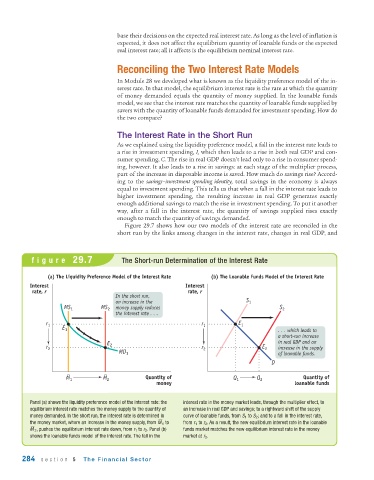

Figure 29.7 shows how our two models of the interest rate are reconciled in the

short run by the links among changes in the interest rate, changes in real GDP, and

figure 29.7 The Short -run Determination of the Interest Rate

(a) The Liquidity Preference Model of the Interest Rate (b) The Loanable Funds Model of the Interest Rate

Interest Interest

rate, r rate, r

In the short run,

an increase in the S 1

MS 1 MS 2 money supply reduces S 2

the interest rate . . .

E

r 1 r 1 1

E 1 . . . which leads to

a short-run increase

E 2 in real GDP and an

r 2 r 2 E 2 increase in the supply

MD 1 of loanable funds.

D

M 1 M 2 Quantity of Q 1 Q 2 Quantity of

money loanable funds

Panel (a) shows the liquidity preference model of the interest rate: the interest rate in the money market leads, through the multiplier effect, to

equilibrium interest rate matches the money supply to the quantity of an increase in real GDP and savings; to a rightward shift of the supply

money demanded. In the short run, the interest rate is determined in curve of loanable funds, from S 1 to S 2 ; and to a fall in the interest rate,

––

the money market, where an increase in the money supply, from M 1 to from r 1 to r 2 . As a result, the new equilibrium interest rate in the loanable

––

M 2 , pushes the equilibrium interest rate down, from r 1 to r 2 . Panel (b) funds market matches the new equilibrium interest rate in the money

shows the loanable funds model of the interest rate. The fall in the market at r 2 .

284 section 5 The Financial Sector