Page 323 - Krugmans Economics for AP Text Book_Neat

P. 323

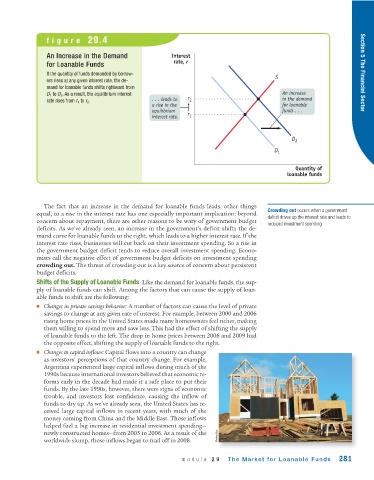

figure 29.4

An Increase in the Demand Interest

rate, r

for Loanable Funds

If the quantity of funds demanded by borrow- Section 5 The Financial Sector

S

ers rises at any given interest rate, the de-

mand for loanable funds shifts rightward from

D 1 to D 2 . As a result, the equilibrium interest An increase

rate rises from r 1 to r 2 . . . . leads to r 2 in the demand

a rise in the for loanable

equilibrium funds . . .

interest rate. r 1

D 2

D 1

Quantity of

loanable funds

The fact that an increase in the demand for loanable funds leads, other things

Crowding out occurs when a government

equal, to a rise in the interest rate has one especially important implication: beyond

deficit drives up the interest rate and leads to

concern about repayment, there are other reasons to be wary of government budget

reduced investment spending.

deficits. As we’ve already seen, an increase in the government’s deficit shifts the de-

mand curve for loanable funds to the right, which leads to a higher interest rate. If the

interest rate rises, businesses will cut back on their investment spending. So a rise in

the government budget deficit tends to reduce overall investment spending. Econo-

mists call the negative effect of government budget deficits on investment spending

crowding out. The threat of crowding out is a key source of concern about persistent

budget deficits.

Shifts of the Supply of Loanable Funds Like the demand for loanable funds, the sup-

ply of loanable funds can shift. Among the factors that can cause the supply of loan-

able funds to shift are the following:

■ Changes in private savings behavior: A number of factors can cause the level of private

savings to change at any given rate of interest. For example, between 2000 and 2006

rising home prices in the United States made many homeowners feel richer, making

them willing to spend more and save less. This had the effect of shifting the supply

of loanable funds to the left. The drop in home prices between 2006 and 2009 had

the opposite effect, shifting the supply of loanable funds to the right.

■ Changes in capital inflows: Capital flows into a country can change

as investors’ perceptions of that country change. For example,

Argentina experienced large capital inflows during much of the

1990s because international investors believed that economic re-

forms early in the decade had made it a safe place to put their

funds. By the late 1990s, however, there were signs of economic

trouble, and investors lost confidence, causing the inflow of

funds to dry up. As we’ve already seen, the United States has re-

ceived large capital inflows in recent years, with much of the

money coming from China and the Middle East. Those inflows

helped fuel a big increase in residential investment spending—

newly constructed homes—from 2003 to 2006. As a result of the Photodisc

worldwide slump, those inflows began to trail off in 2008.

module 29 The Market for Loanable Funds 281