Page 78 - Sample Financial Plan 4-1-2019 v2

P. 78

Securities and investment advisory services offered through Woodbury Financial Services, Inc. (WFS),

member FINRA/SIPC. WFS is separately owned and other entities and/or marketing names, products, or

services referenced here are independent of WFS.

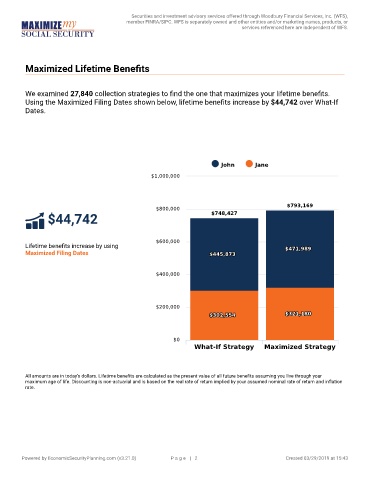

Maximized Lifetime Benefits

We examined 27,840 collection strategies to find the one that maximizes your lifetime benefits.

Using the Maximized Filing Dates shown below, lifetime benefits increase by $44,742 over What-If

Dates.

-

John Jane

$1,000,000

$793,169

$793,169

$800,000

$748,427

$44,742 $748,427

$600,000

Lifetime benefits increase by using $471,989

$471,989

Maximized Filing Dates $445,873

$445,873

$400,000

$200,000

$321,180

$302,554 $321,180

$302,554

$0

What-If Strategy Maximized Strategy

All amounts are in today's dollars. Lifetime benefits are calculated as the present value of all future benefits assuming you live through your

maximum age of life. Discounting is non-actuarial and is based on the real rate of return implied by your assumed nominal rate of return and inflation

rate.

Powered by EconomicSecurityPlanning.com (v3.21.0) P a g e | 2 Created 03/29/2019 at 15:43