Page 73 - Sample Financial Plan 4-1-2019 v2

P. 73

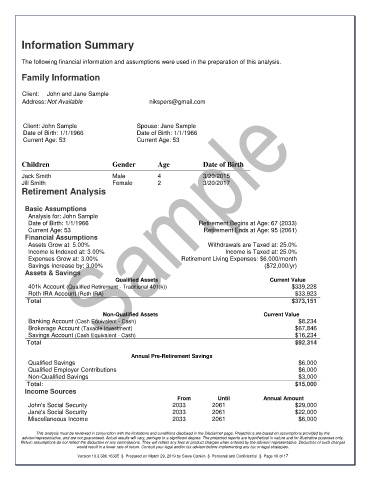

Information Summary

The following financial information and assumptions were used in the preparation of this analysis.

Family Information

Client: John and Jane Sample

Address: Not Available nikspers@gmail.com

Client: John Sample Spouse: Jane Sample

Date of Birth: 1/1/1966 Date of Birth: 1/1/1966

Current Age: 53 Current Age: 53

Children Gender Age Date of Birth

Jack Smith Male 4 3/20/2015

Jill Smith Female 2 3/20/2017

Retirement Analysis

Basic Assumptions

Analysis for: John Sample

Date of Birth: 1/1/1966 Retirement Begins at Age: 67 (2033)

Current Age: 53 Retirement Ends at Age: 95 (2061)

Financial Assumptions

Assets Grow at: 5.00% Withdrawals are Taxed at: 25.0%

Income is Indexed at: 3.00% Income is Taxed at: 25.0%

Expenses Grow at: 3.00% Retirement Living Expenses: $6,000/month

Savings Increase by: 3.00% ($72,000/yr)

Assets & Savings

Qualified Assets Current Value

401k Account (Qualified Retirement - Traditional 401(k)) $339,228

Roth IRA Account (Roth IRA) $33,923

Total $373,151

Non-Qualified Assets Current Value

Banking Account (Cash Equivalent - Cash) $8,234

Brokerage Account (Taxable Investment) $67,846

Savings Account (Cash Equivalent - Cash) $16,234

Total $92,314

Annual Pre-Retirement Savings

Qualified Savings $6,000

Qualified Employer Contributions $6,000

Non-Qualified Savings $3,000

Total: $15,000

Income Sources

From Until Annual Amount

John's Social Security 2033 2061 $29,000

Jane's Social Security 2033 2061 $22,000

Miscellaneous Income 2033 2061 $6,000

This analysis must be reviewed in conjunction with the limitations and conditions disclosed in the Disclaimer page. Projections are based on assumptions provided by the

advisor/representative, and are not guaranteed. Actual results will vary, perhaps to a significant degree. The projected reports are hypothetical in nature and for illustrative purposes only.

Return assumptions do not reflect the deduction of any commissions. They will reflect any fees or product charges when entered by the advisor/ representative. Deduction of such charges

would result in a lower rate of return. Consult your legal and/or tax advisor before implementing any tax or legal strategies.

Version 10.3.386.16335 § Prepared on March 29, 2019 by Steve Conkin § Personal and Confidential § Page 16 of 17