Page 68 - Sample Financial Plan 4-1-2019 v2

P. 68

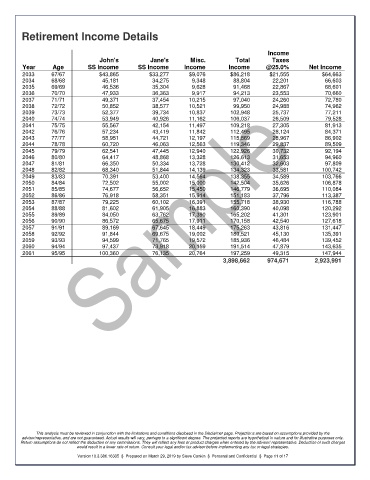

Retirement Income Details

Income

John's Jane's Misc. Total Taxes

Year Age SS Income SS Income Income Income @25.0% Net Income

2033 67/67 $43,865 $33,277 $9,076 $86,218 $21,555 $64,663

2034 68/68 45,181 34,275 9,348 88,804 22,201 66,603

2035 69/69 46,536 35,304 9,628 91,468 22,867 68,601

2036 70/70 47,933 36,363 9,917 94,213 23,553 70,660

2037 71/71 49,371 37,454 10,215 97,040 24,260 72,780

2038 72/72 50,852 38,577 10,521 99,950 24,988 74,962

2039 73/73 52,377 39,734 10,837 102,948 25,737 77,211

2040 74/74 53,949 40,926 11,162 106,037 26,509 79,528

2041 75/75 55,567 42,154 11,497 109,218 27,305 81,913

2042 76/76 57,234 43,419 11,842 112,495 28,124 84,371

2043 77/77 58,951 44,721 12,197 115,869 28,967 86,902

2044 78/78 60,720 46,063 12,563 119,346 29,837 89,509

2045 79/79 62,541 47,445 12,940 122,926 30,732 92,194

2046 80/80 64,417 48,868 13,328 126,613 31,653 94,960

2047 81/81 66,350 50,334 13,728 130,412 32,603 97,809

2048 82/82 68,340 51,844 14,139 134,323 33,581 100,742

2049 83/83 70,391 53,400 14,564 138,355 34,589 103,766

2050 84/84 72,502 55,002 15,000 142,504 35,626 106,878

2051 85/85 74,677 56,652 15,450 146,779 36,695 110,084

2052 86/86 76,918 58,351 15,914 151,183 37,796 113,387

2053 87/87 79,225 60,102 16,391 155,718 38,930 116,788

2054 88/88 81,602 61,905 16,883 160,390 40,098 120,292

2055 89/89 84,050 63,762 17,390 165,202 41,301 123,901

2056 90/90 86,572 65,675 17,911 170,158 42,540 127,618

2057 91/91 89,169 67,645 18,449 175,263 43,816 131,447

2058 92/92 91,844 69,675 19,002 180,521 45,130 135,391

2059 93/93 94,599 71,765 19,572 185,936 46,484 139,452

2060 94/94 97,437 73,918 20,159 191,514 47,879 143,635

2061 95/95 100,360 76,135 20,764 197,259 49,315 147,944

3,898,662 974,671 2,923,991

This analysis must be reviewed in conjunction with the limitations and conditions disclosed in the Disclaimer page. Projections are based on assumptions provided by the

advisor/representative, and are not guaranteed. Actual results will vary, perhaps to a significant degree. The projected reports are hypothetical in nature and for illustrative purposes only.

Return assumptions do not reflect the deduction of any commissions. They will reflect any fees or product charges when entered by the advisor/ representative. Deduction of such charges

would result in a lower rate of return. Consult your legal and/or tax advisor before implementing any tax or legal strategies.

Version 10.3.386.16335 § Prepared on March 29, 2019 by Steve Conkin § Personal and Confidential § Page 11 of 17