Page 69 - Sample Financial Plan 4-1-2019 v2

P. 69

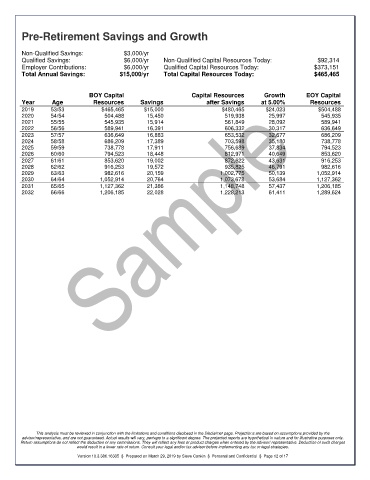

Pre-Retirement Savings and Growth

Non-Qualified Savings: $3,000/yr

Qualified Savings: $6,000/yr Non-Qualified Capital Resources Today: $92,314

Employer Contributions: $6,000/yr Qualified Capital Resources Today: $373,151

Total Annual Savings: $15,000/yr Total Capital Resources Today: $465,465

BOY Capital Capital Resources Growth EOY Capital

Year Age Resources Savings after Savings at 5.00% Resources

2019 53/53 $465,465 $15,000 $480,465 $24,023 $504,488

2020 54/54 504,488 15,450 519,938 25,997 545,935

2021 55/55 545,935 15,914 561,849 28,092 589,941

2022 56/56 589,941 16,391 606,332 30,317 636,649

2023 57/57 636,649 16,883 653,532 32,677 686,209

2024 58/58 686,209 17,389 703,598 35,180 738,778

2025 59/59 738,778 17,911 756,689 37,834 794,523

2026 60/60 794,523 18,448 812,971 40,649 853,620

2027 61/61 853,620 19,002 872,622 43,631 916,253

2028 62/62 916,253 19,572 935,825 46,791 982,616

2029 63/63 982,616 20,159 1,002,775 50,139 1,052,914

2030 64/64 1,052,914 20,764 1,073,678 53,684 1,127,362

2031 65/65 1,127,362 21,386 1,148,748 57,437 1,206,185

2032 66/66 1,206,185 22,028 1,228,213 61,411 1,289,624

This analysis must be reviewed in conjunction with the limitations and conditions disclosed in the Disclaimer page. Projections are based on assumptions provided by the

advisor/representative, and are not guaranteed. Actual results will vary, perhaps to a significant degree. The projected reports are hypothetical in nature and for illustrative purposes only.

Return assumptions do not reflect the deduction of any commissions. They will reflect any fees or product charges when entered by the advisor/ representative. Deduction of such charges

would result in a lower rate of return. Consult your legal and/or tax advisor before implementing any tax or legal strategies.

Version 10.3.386.16335 § Prepared on March 29, 2019 by Steve Conkin § Personal and Confidential § Page 12 of 17