Page 6 - Lawyer Copy of Final Version MPRC COLLATERAL OPTION 4 (8.5 × 11 in) (1)_Neat

P. 6

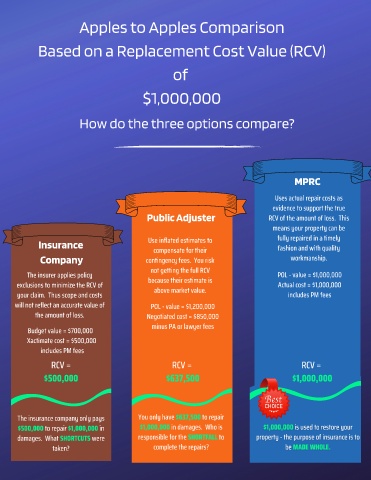

Apples to Apples Comparison

Based on a Replacement Cost Value (RCV)

of

$1,000,000

How do the three options compare?

MPRC

Uses actual repair costs as

evidence to support the true

Public Adjuster RCV of the amount of loss. This

means your property can be

Insurance Use inflated estimates to fully repaired in a timely

compensate for their fashion and with quality

Company contingency fees. You risk workmanship.

not getting the full RCV

The insurer applies policy POL - value = $1,000,000

because their estimate is

exclusions to minimize the RCV of Actual cost = $1,000,000

above market value.

your claim. Thus scope and costs includes PM fees

will not reflect an accurate value of POL - value = $1,200,000

the amount of loss. Negotiated cost = $850,000

minus PA or lawyer fees

Budget value = $700,000

Xactimate cost = $500,000

includes PM fees

RCV = RCV = RCV =

$500,000 $637,500 $1,000,000

The insurance company only pays You only have $637,500 to repair

$500,000 to repair $1,000,000 in $1,000,000 in damages. Who is

damages. What SHORTCUTS were responsible for the SHORTFALL to

taken? complete the repairs?