Page 91 - NIB Annual Report 12-13 | 13-14

P. 91

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

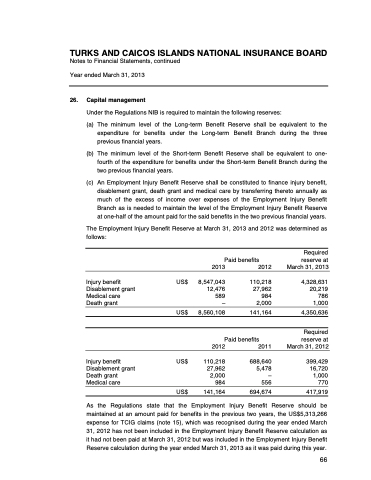

26. Capital management

Under the Regulations NIB is required to maintain the following reserves:

(a) The minimum level of the Long-term Benefit Reserve shall be equivalent to the expenditure for benefits under the Long-term Benefit Branch during the three previous financial years.

(b) The minimum level of the Short-term Benefit Reserve shall be equivalent to one- fourth of the expenditure for benefits under the Short-term Benefit Branch during the two previous financial years.

(c) An Employment Injury Benefit Reserve shall be constituted to finance injury benefit, disablement grant, death grant and medical care by transferring thereto annually as much of the excess of income over expenses of the Employment Injury Benefit Branch as is needed to maintain the level of the Employment Injury Benefit Reserve at one-half of the amount paid for the said benefits in the two previous financial years.

The Employment Injury Benefit Reserve at March 31, 2013 and 2012 was determined as follows:

Paid benefits

Required reserve at March 31, 2013

4,328,631 20,219 786 1,000

4,350,636

Required reserve at March 31, 2012

399,429 16,720 1,000 770

417,919

Injury benefit Disablement Medical care Death grant

Injury benefit Disablement Death grant Medical care

US$ grant

US$

US$ grant

US$

2013

8,547,043 12,476 589 –

8,560,108

2012

110,218 27,962 984 2,000

141,164

Paid benefits 2012 2011

110,218 688,640 27,962 5,478 2,000 – 984 556

141,164 694,674

As the Regulations state that the Employment Injury Benefit Reserve should be

maintained at an amount paid for benefits in the previous two years, the US$5,313,266

expense for TCIG claims (note 15), which was recognised during the year ended March

31, 2012 has not been included in the Employment Injury Benefit Reserve calculation as

it had not been paid at March 31, 2012 but was included in the Employment Injury Benefit

Reserve calculation during the year ended March 31, 2013 as it was paid during this year.

2013 & 2014 ANNUAL REPORT | 87 66