Page 89 - NIB Annual Report 12-13 | 13-14

P. 89

TURKS AND CAICOS ISLANDS NATIONAL INSURANCE BOARD

Notes to Financial Statements, continued Year ended March 31, 2013

25. Financial instruments, continued

(c) Market risk, continued

(ii) Price risk, continued

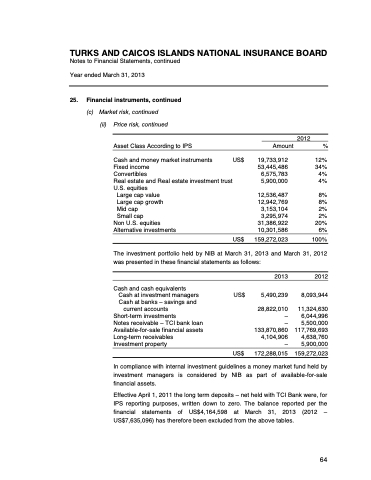

Asset Class According to IPS

Cash and money market instruments

Fixed income

Convertibles

Real estate and Real estate investment trust U.S. equities

Large cap value Large cap growth Mid cap

Small cap

Non U.S. equities Alternative investments

US$

Amount 2012 %

19,733,912 12% 53,445,486 34% 6,575,783 4% 5,900,000 4%

12,536,487 8% 12,942,769 8% 3,153,104 2% 3,295,974 2% 31,386,922 20% 10,301,586 6%

US$ 159,272,023 100%

The investment portfolio held by NIB at March 31, 2013 and March 31, 2012 was presented in these financial statements as follows:

Cash and cash equivalents Cash at investment managers Cash at banks – savings and

current accounts

Short-term investments

Notes receivable – TCI bank loan Available-for-sale financial assets Long-term receivables Investment property

US$

2013

5,490,239

28,822,010 – – 133,870,860 4,104,906 –

2012

8,093,944

11,324,630 6,044,996 5,500,000

117,769,693 4,638,760 5,900,000

159,272,023

US$ 172,288,015

In compliance with internal investment guidelines a money market fund held by investment managers is considered by NIB as part of available-for-sale financial assets.

Effective April 1, 2011 the long term deposits – net held with TCI Bank were, for IPS reporting purposes, written down to zero. The balance reported per the financial statements of US$4,164,598 at March 31, 2013 (2012 – US$7,635,096) has therefore been excluded from the above tables.

2013 & 2014 ANNUAL REPORT | 85 64